Falling profits pressuring salaries in Turkey

Mustafa Sönmez - mustafasnmz@hotmail.com

Signs are strengthening that falling profits in the industrial sector, particularly acute over the past two years, will drag Turkey into a significant bottleneck in 2016.

Signs are strengthening that falling profits in the industrial sector, particularly acute over the past two years, will drag Turkey into a significant bottleneck in 2016. This decline in real profits in large industry, which constitutes the backbone of the economy, is expected to pressure companies to take shortcuts, increase prices, and cut back on workers, thus increasing tensions in many workplaces.

End of honeymoon

Most industrial companies grew significantly from 2003 to 2007 by focusing on the domestic market, which was stimulated with low interest rates and low exchange rates. There was also a particular emphasis on construction as a growth locomotive.

This period also saw an extraordinary inflow of foreign resources compared to pre-2002. However, after 2008 - especially in the years 2014 and 2015 – this climate changed, and many companies’ profits fell. While domestic demand has struggled, the most important factor behind the drop is that exports have not risen despite the foreign exchange rate being good for exporters. In fact, those exports have declined by more than 10 percent.

Employers are therefore looking at cost-cutting measures such as lowering salary expenses and cutting employment. There is systematic opposition, for example, to the government’s current plans to raise the minimum wage.

Forex hike

The growth paradigm of the past 13 years was built upon foreign capital inflows and the domestic market, but this no longer functions the same anymore. With the fall in foreign inflows and the hike in foreign exchange rates associated with this fall, company balance sheets have been badly affected. Import inputs increase costs and create pressure for price increases domestically, which makes it difficult to compete in international markets.

Many firms, particularly the 500 biggest industrial companies, have recorded losses because of the hike in foreign exchange rates. However, the income of those companies that predicted the hike in advance and linked their resources to foreign currencies increased.

A little over half of any profits made in recent years consist of net foreign exchange gains. What’s more, the production powers of companies are not resilient to international competition.

As a result, as accidental cyclical foreign currency gains are not sustainable, firms are feeling the need for measures to cut costs and increase their competitive power.

But instead of raising competitive power by investing in research and development and technological renewals, companies are looking to cut on salary expenses. This in turn heralds further injustices in income distribution, in a country that already contains huge inequalities.

Drop in profits

Reviewing the final profits of the biggest 500 industrial companies, it can be seen that their performances have fallen compared to 2013. The 500 biggest companies, which increased their operating profits in 2013 to 8 percent of their net sales, in 2014 saw their net sales decrease to 6.4 percent of the operating profit rate. These companies had operational profits of 36 billion liras in 2013, but this fell to 30 billion liras in 2014.

Non-production incomes

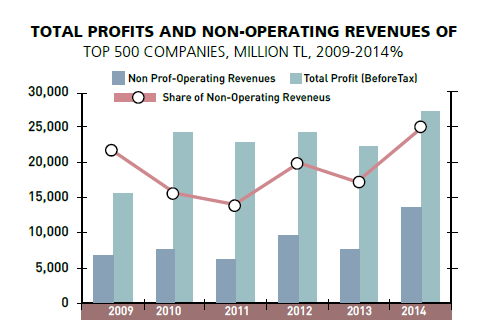

The non-production income of the top 500 industrial firms has for years been reviewed separately. Non-production income consists of interest rate income, net foreign exchange profits, sale of movable and fixed assets, and dividend yields.

When companies include as “non-production income” the income from sales of land and buildings, interest rates and foreign currency, then their period-based income appears increased.

In certain years in the 2000s, there were investments in foreign currency. For instance, in 2014 the U.S. dollar’s annual nominal yield reached 11 percent and 2.7 percent in real terms. Those who invested some of their resources in foreign currency thus earned real profits. In the January-November period of 2015, the nominal yield of the dollar reached 28.5 percent and its real yield was 19 percent. If in 2015 also firms had channeled their resources in this direction, then their non-production income would have significantly exceeded their production profits.

Share of non-production

Non-production income and its share in the period statement of profit and loss fluctuate over the years. The non-production income of the top 500 companies in 2012 increased 53.4 percent on the previous year to reach 9.6 billion liras. In 2013, it dropped by 21.5 percent to 7.5 billion liras. In 2014 when foreign currency went up, these types of profits skyrocketed, increasing to 80.6 percent to become 13.6 billion liras.

The share of non-production income in periodic profit and loss statements was 34.1 percent in 2013. But in 2014 this went up to 50.3 percent. In other words, investment in foreign currency yielded more profits than production.

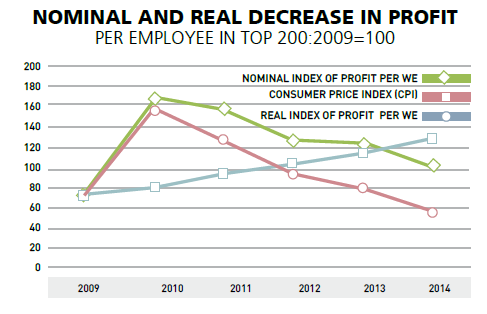

Profit per employee

To be able to see the drop in profit rates in industry, looking at profit per employee is more explanatory. When this is done, the profit based on industrial activities per employee in 2009 was 170,000 liras. This figure, in current prices, went up to 211,000 liras in 2014. However, when this is calculated free of inflation, there is a 14 percent drop in real profits. Especially in the year between 2013 to 2014, it is remarkable that profits per employee have decreased by 18 percent.

Costs and measures

Research by the Central Bank shows that industrial production costs, such as raw materials based on imports and salary expenses, constitute a large share, creating sensitivity among employer.

A Turkish Statistical Institute (TÜİK) survey for 2006-2011 shows that the highest share in company costs in Turkey is made up of raw material expenses, at 41.5 percent. This is followed by personnel expenses at 23.6 percent.

As a result, it is inevitable for industrial firms to reflect cost increases on prices. With these higher prices, competition and market issues will tend to soar.

Another cost issue is that of salaries. Curbing salary increases is already on the agenda, as well as asking for facilitation for taxes and insurance premiums. Companies are also expected to opt for layoffs, while asking for assistance in meeting severance pay.

All this looks likely to create new tensions in the near future, especially in employer-employee relations.