Eurozone offers 30 bln euros for distressed Spanish banks

BEIJING - Agence France-Presse

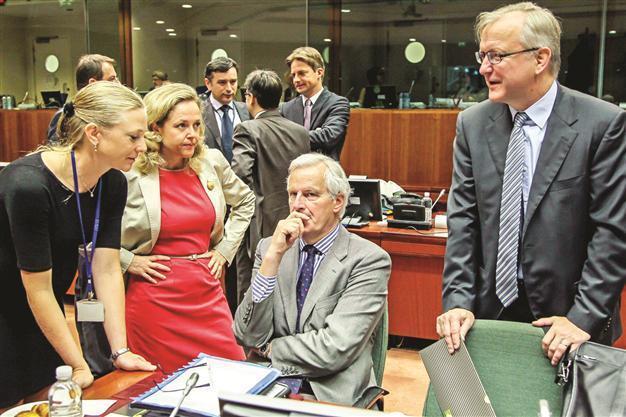

EU Commissioner for Internal Market and Services Michel Barnier (C) and Monetary Affairs European Commissioner Olli Rehn (R), at a finance ministers council yesterday.

Eurozone finance ministers agreed yesterday to offer Spain 30 billion euros this month to help its distressed banks as they raced to stay ahead of market scepticism.After nine hours of talks, Jean-Claude Juncker, the Luxembourg premier who also heads the Eurogroup , said a memorandum of understanding for Spain would be formally signed “in the second half of July,” with 30 billion euros ($37 billion) available by the end of the month.

Juncker, who has been in the job since 2005, was reappointed by the 17 ministers during talks July 9 which ended well after midnight.

Spain, under increasing pressure as sceptical markets pushed its borrowing costs dangerously high again, had called for up to 100 billion euros in direct aid at a June 28-29 “breakthrough” EU summit.

Aiming to keep the momentum going, ministers also agreed to extend a deadline for Spain to cut its public deficit to the EU 3.0 percent limit by one year to 2014 because of the difficult economic conditions Spain faces.

Must implement measures

At the same time, however, Juncker stressed that Madrid must implement measures needed to bring its public finances into line with EU norms.

EU economic affairs commissioner Olli Rehn said Spain’s public deficit -- the shortfall of revenue to spending -- was now expected at 6.3 percent of Gross Domestic Product this year, 4.5 percent in 2013 and then 2.8 percent in 2014.

Spain in May revised its 2011 public deficit figure, saying that it stood at 8.9 percent, up from 8.51 percent reported earlier and way above the original 6.0 percent target for the year.

Spanish Prime Minister Mariano Rajoy announced on July 7 that he would take additional steps soon to cut the public deficit and said “Europe must fulfil the accords as swiftly as possible.”

In another key appointment, Germany’s Klaus Regling, head of the eurozone’s temporary EFSF bailout fund, was named to run its permanent successor, the European Stability Mechanism. The June summit agreed that the ESM will be able to inject funds directly into needy banks, conditional on a new European bank regulator being put in place, so as to avoid adding to the debt burden of the affected state.

Asked if such a state would have to provide guarantees on such bank funding, Juncker answered with a simple “No.” Rehn confirmed that position, a key issue for nervous investors, but also highlighted the importance of getting the new regulator -- to be built around the European Central Bank -- in place quickly.

The European Financial Stability Facility (EFSF) was set up in 2010 after a first Greek bailout but it became clear after Ireland and Portugal also had to be rescued that a more powerful backstop was needed.

The ESM has funds of 500 billion euros and was supposed to be operational from this month but it has been delayed, with final ratification still pending in several member states.

French Finance Minister Pierre Moscovici said the meeting had been able to make progress on several fronts and had established a heavy timetable through to the end of the year.

The Spanish bank accord should be concluded by end-July and ultimately run up to 100 billion euros, he said, also highlighting the need for Madrid to implement tough reforms of the sector.