Eurobonds will come: Italy

ATHENS - Agence France-Presse

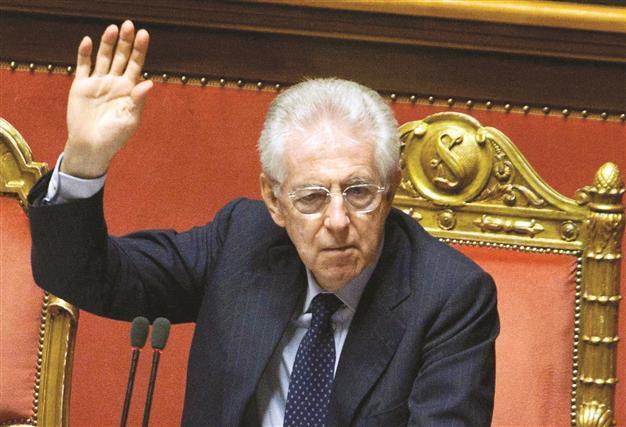

‘I believe we will have eurobonds is some form or other, Italian premier Monti says. AP Photo

Italy’s Prime Minister Mario Monti believes

eurobonds, a contested tool proposed as a way of alleviating the eurozone crisis, will eventually become reality, he told a Greek newspaper yesterday.

“I believe we will have eurobonds is some form or other, because our (European) union is getting closer,” Monti told To Vima, warning however they were not a “licence to spend” or an alternative to cutting debt.

In the same newspaper, however, German Foreign Minister Guido Westerwelle reiterated Berlin’s opposition, saying eurobonds would “increase debt and reduce competitiveness.” Underwritten by all eurozone countries, eurobonds would allow troubled members such as Greece to raise funds at much less painful interest rates than if they borrowed on their own. Backers include new French President Francois Hollande.

But German Chancellor Angela Merkel is opposed, seeing a risk that eurobonds would reduce the incentive to balance budgets and cut debt, while also pushing Germany’s own borrowing costs higher.

Interest rates on two-year German bonds on Friday went negative for the first time as investors worried about financial turmoil sought a safe haven for their cash -- effectively meaning they have to pay Berlin to lend it money. Monti said meanwhile that he was “certain” Greece would not leave the eurozone even after June 17 elections that investors fear will result in just such a scenario, potentially spelling turmoil for Monti’s own country, Spain and others.

He stressed however that Athens had to “continue and intensify its work to create a strong economy,” a reference to the austerity cuts Greece has promised in return for bailouts from the European Union and International Monetary Fund.

A previous election in early May saw parties opposed to more cuts win a majority of the vote, but forming a coalition proved impossible, meaning Greeks will return to polling stations again in two weeks.

If Greece reneges on its commitments the flow of funds will cease and the country will quickly become insolvent and will have to leave the eurozone, an event with potentially calamitous consequences, and not just in Greece.

Westerwelle for his part said that he wants Greece to remain in the currency union and expressed confidence that voters would “take the right decisions,” while adding that the terms of the bailouts “must be respected.”