Diageo strikes $2 bln deal with India's United Spirits

HONG KONG/MUMBAI – Reuters

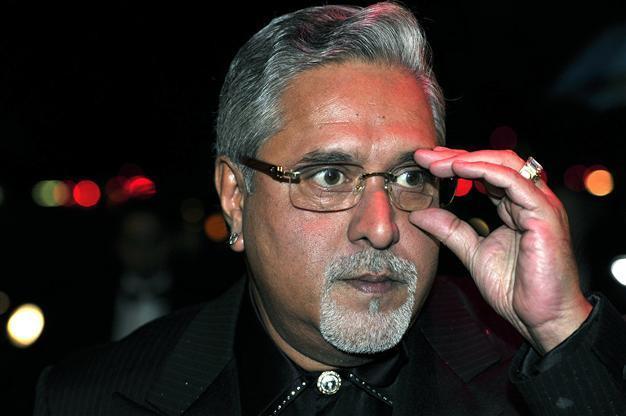

In this photograph taken on October 26, 2012, Indian entrepreneur Vijay Mallya, owner of United Breweries, Kingfisher Airlines and Force India F1 team, arrives to attend the The Asian Awards, at The Grosvenor House Hotel in central London. British drinks giant Diageo is in talks to buy a stake in India's United Spirits, the two companies said in a brief statement September 25, 2012. AFP Photo

Diageo is set to buy a controlling stake in Indian liquor baron Vijay Mallya's United Spirits in a deal worth over $2 billion, a memo showed, giving the world's biggest spirits group a bigger slice of a fast-growing market.The purchase would be the biggest inbound Indian M&A deal since British oil firm Cairn Energy's sold a majority stake in its Indian business to Vedanta Resources Plc last year. The Diageo deal concludes an on-again, off-again courtship that began in 2008.

The deal was expected to be announced after the close of Indian stock markets on Nov. 9 in the evening, according to the internal memo detailing the transaction obtained by Reuters.

Diageo had acquired Mey İçki, the largest distiller in Turkey, for

$2.1 billion (£1.3 billion) from Private equity fund TPG Capital, in August, 2011.