Debt burden on Turkey’s industry becoming heavier

Mustafa Sönmez - mustafasnmz@hotmail.com

AA Photo

Turkey’s economy has experienced serious financial fluctuations since the second half of 2013. These troubles continued and increased in 2014 and 2015. Even though industrial firms tried to maintain their gross profits in sales, they had to share a significant portion of the value produced with the banking-finance sector in “interest rates.”

Everybody agrees industrial firms were defeated under the financial pressure of foreign exchange rates and interest rates.

In 2013, the financial expenses of industrial firms reached almost half of their real operating profits. In 2014, the same was experienced. When real operating profits are reviewed in industry, it can be seen that there has been a serious decline in the performances of the top 500 companies.

The 500 major industrial firms had 36.5 billion Turkish Liras in operating profits in 2013 and they lost 11 billion liras as financing expenses. In 2014, the 500 big firms had to use more than half of their 30-billion-lira real operating profits, some 16 billion liras, for financial expenses.

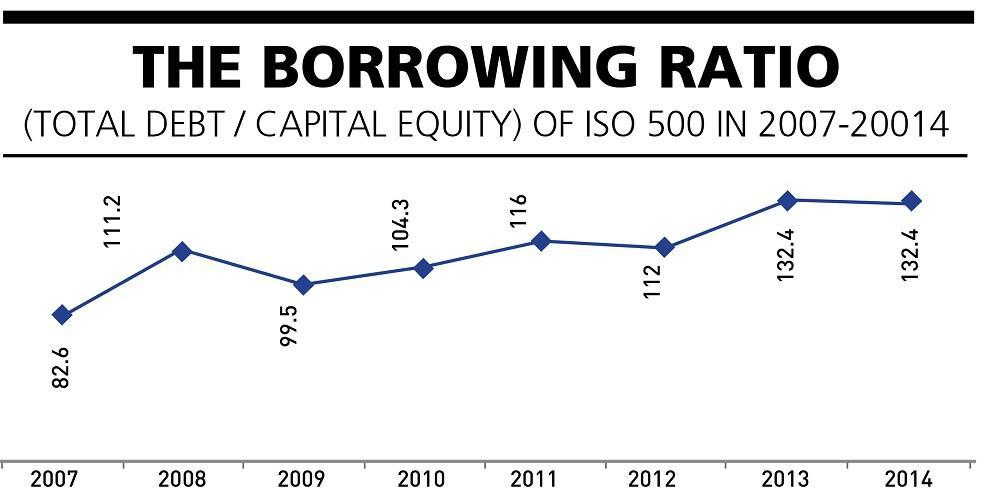

Borrowing ratio

One of the most significant parameters on whether or not the financial structure of an industrial company is healthy is the ratio of total debts to equity capitals.

The first 500 firms in industry have been observed to borrow rapidly compared to their equity capitals and that this situation was not able to be curbed in the past. The accepted debt/equity ratio is 70 percent in the world; the industrial firms in Turkey at the beginning of the 2000s had an average borrowing ratio of 80 percent. This figure did not decrease in 2013 or 2014. New loans were taken to overcome the problems faced and the loans of the large industry exceeded 132 percent of its equities.

In the set of Turkey’s second biggest 500 industrial enterprises, which are small- and medium-sized enterprises (SMEs), the debt/equity capital ratio, even though it declined in 2014 compared to the previous year, is over 150 percent.

Where do they borrow from?

Where do they borrow from?Turkey’s top 500 firms had 193 billion liras of equity capital in 2014 while their debts were 256 billion liras.

The second 500, most of them SMEs, had nearly 33 billion liras as equity capital and their total debts were almost 50 billion liras.

Thus the first 1,000 industrial firms had 226 billion liras of equity capital while their debts were 306 billion liras. This corresponds to a debt to equity capital ratio of 135 percent, very much above the norm of 70 percent.

Where does the industry loan from? Their first source is banks and these can be in lira or foreign currency credits. The second source is foreign currency external loans.

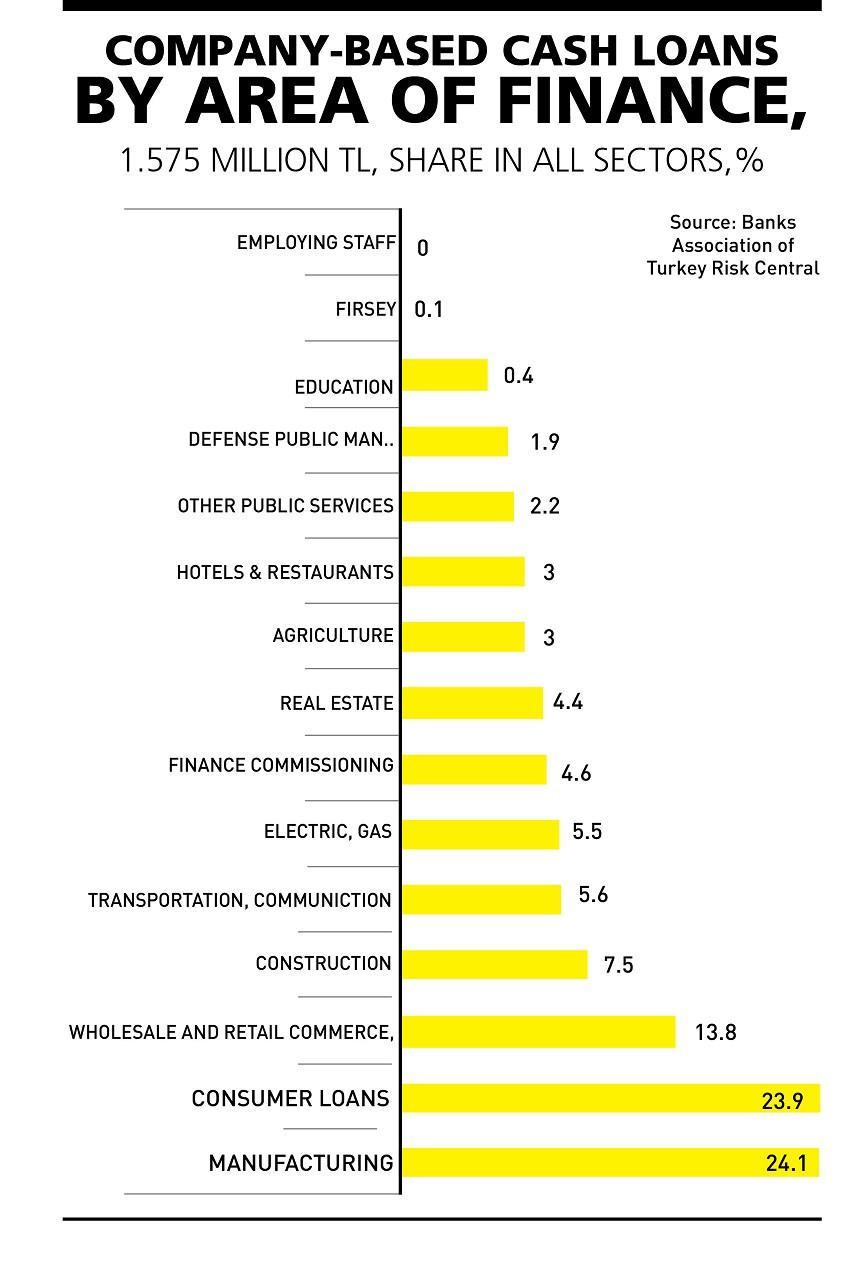

According to data from the Banks Association of Turkey Risk Center, by June 2015 money loans from the banking system had reached 1,575 billion liras. The same source said bad credits were 40 billion liras. This is a little bit less than 2.5 percent of gross loans that reach 1,615 billion liras. This is not considered at an alarming dimension yet.

Resources or loans that firms used directly through bank loans or bank guarantees reached 1.6 trillion liras in June 2015. The metal industry was the biggest borrower among subsectors with 3.6 percent. The textile-ready made clothing sector followed with a 3.5-percent share. About the same amount of loans were used by firms from the food industry.

Foreign currency loans

More than 30 percent of bank loans totaling 1.6 trillion liras are foreign exchange loans. In 2015 when the foreign exchange rate skyrocketed, the fact that these loans have a share of nearly one-third is a big risk in terms of the future of companies.

Excluding export credits, those who are the biggest borrowers in foreign currency are users of investment and working capital loans. In consumer credits, which are predominantly housing credits, foreign currency loans are scarce.

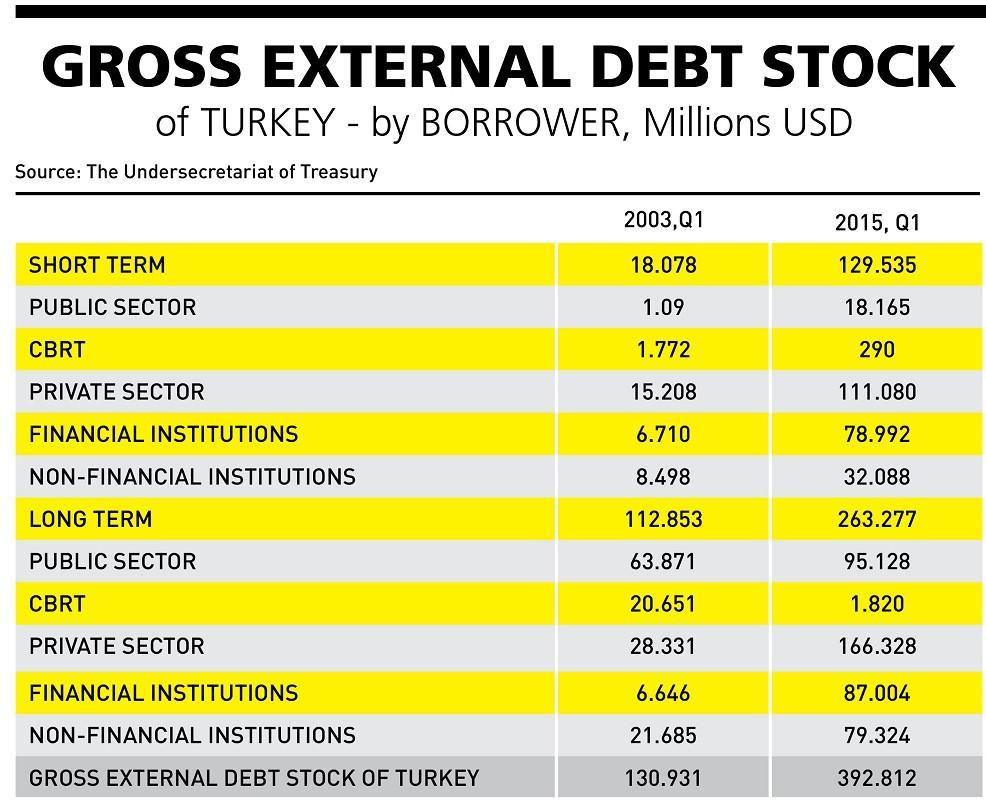

A portion of the loans that firms take because of the inadequacy of their equity capitals are provided by domestic banks; but they also find foreign currency loans abroad. These foreign currency loans of the private sector, except for the banking sector, were nearing $112 billion as of the end of March 2015. When calculated with an exchange rate of 3 liras to the dollar, the loaning from this channel totaled 336 billion liras.

Foreign currency loans via this channel rose from approximately $30 billion to $112 billion between 2003 and March 2015, almost tripling in size. The real sector including the manufacturing sector had $8.5 billion of short-term loans and 21.7 billion dollars of medium-long term loans in 2003. In following years with the foreign exchange rates pursuing a low course, the usage of foreign currency credits abroad increased rapidly and at the end of the first quarter of 2015, they reached $112 billion. While $32 billion of this total consisted of short-term credits, the remaining nearly $80 billion were long-term ones.

The real sector’s $112 billion debt abroad constituted 28.5 percent of the total external debts of $392 billion. It should not be forgotten that this is the total debt of the real sector including the manufacturing sector.

The manufacturing sector that has used one-fourth of bank credits has also used 30 percent of external foreign currency loans; this means that the manufacturing sector has an external loan burden of $34 billion, corresponding to 102 billion liras calculated on the basis of one dollar equals 3 liras.

In short, the top 1,000 industry firms had 206 billion liras in loans as of 2014, a figure 135 percent above their equity capitals while the accepted rate is 70 percent. This constitutes significant foreign exchange and interest rate pressure for industrial firms.

Together with smaller industrial firms and their loans, it is possible to estimate that the total debts of the manufacturing sector are 400 billion liras.

The fact that 30 percent of these loans are foreign currency loans means that industry enterprises have domestic loans worth $40 billion. If you add this figure to the approximately $35 billion external loans, then the sector’s foreign currency liabilities reach $75 billion.

This liability means for each 10 kuruş rise in the dollar exchange rate, there will be an exchange rate loss of 750 million liras for the industry.

Shrinkage

The foreign exchange rate and debt pressure companies are experiencing is expected to increase in the coming months. Especially with the long-expected interest rate increase by the U.S. Fed, the ongoing exit of foreign investors will accelerate and the dollar exchange rate, which has been at 3 liras, may go even further up. Also, the political and geopolitical risks that contribute to this do not show any signs of changing in coming months.

In order to curb the extreme devaluation of the lira against the dollar, the Central Bank’s interest rate increasing interventions are expected to cause industrial firms this time to come under the pressure of the high interest rate. In this case, industry will be pressed by both the increased dollar exchange and the increased domestic interest rates and face an important demand problem because of decreasing domestic demand and non-increasing external demand.

Where do they borrow from?

Where do they borrow from?