Chinese electric car companies cope with European tariffs

LONDON

MG Motor, BYD and other Chinese electric car manufacturers say they will maintain their low sticker prices in Europe even after being hit with hefty tariffs this month.

MG, the best-selling Chinese electric car brand in Europe, says it will guarantee its prices until the end of 2024, having stockpiled cars before the duties took effect.

MG, an historic British company that is now a subsidiary of Shanghai SAIC, now faces EU duties of 35.3 percent.

"Prices in the automobile market have soared in recent years, but our desire to offer technological, safe and low environmental footprint vehicles to French motorists is intact," Julien Robert, vice-president of MG Motor France, said in a statement last week.

BYD, which faces duties of 17 percent, is opening hundreds of dealerships across Europe and is offering discounts on its sedans and SUVs.

Starting at the end of October, Chinese electric cars imported into Europe will be subject to tariffs as high as 45 percent.

The European Commission accuses Chinese manufacturers of receiving massive state subsidies and says the duties are necessary to create a level playing fields.

Tesla, which is being hit with duty of just 7.8 percent, initially raised prices on its Chinese-made Model 3 sedan before lowering them on Oct. 8.

Xpeng, which only offers high-end models in Europe, also told AFP it will not increase prices.

According to Sebastien Amichi, a consultant at Kearney, Chinese companies may be able to avoid jacking up prices for two to three years, especially if they receive help from the Chinese government.

Chinese car sales in Europe remain modest, about 300,000 in 2024 out of a market of 15 million vehicles, and therefore easy to subsidise, he said.

Meanwhile, MG, BYD and Chery plan to open factories in Hungary, Spain and Turkey to avoid the tariffs.

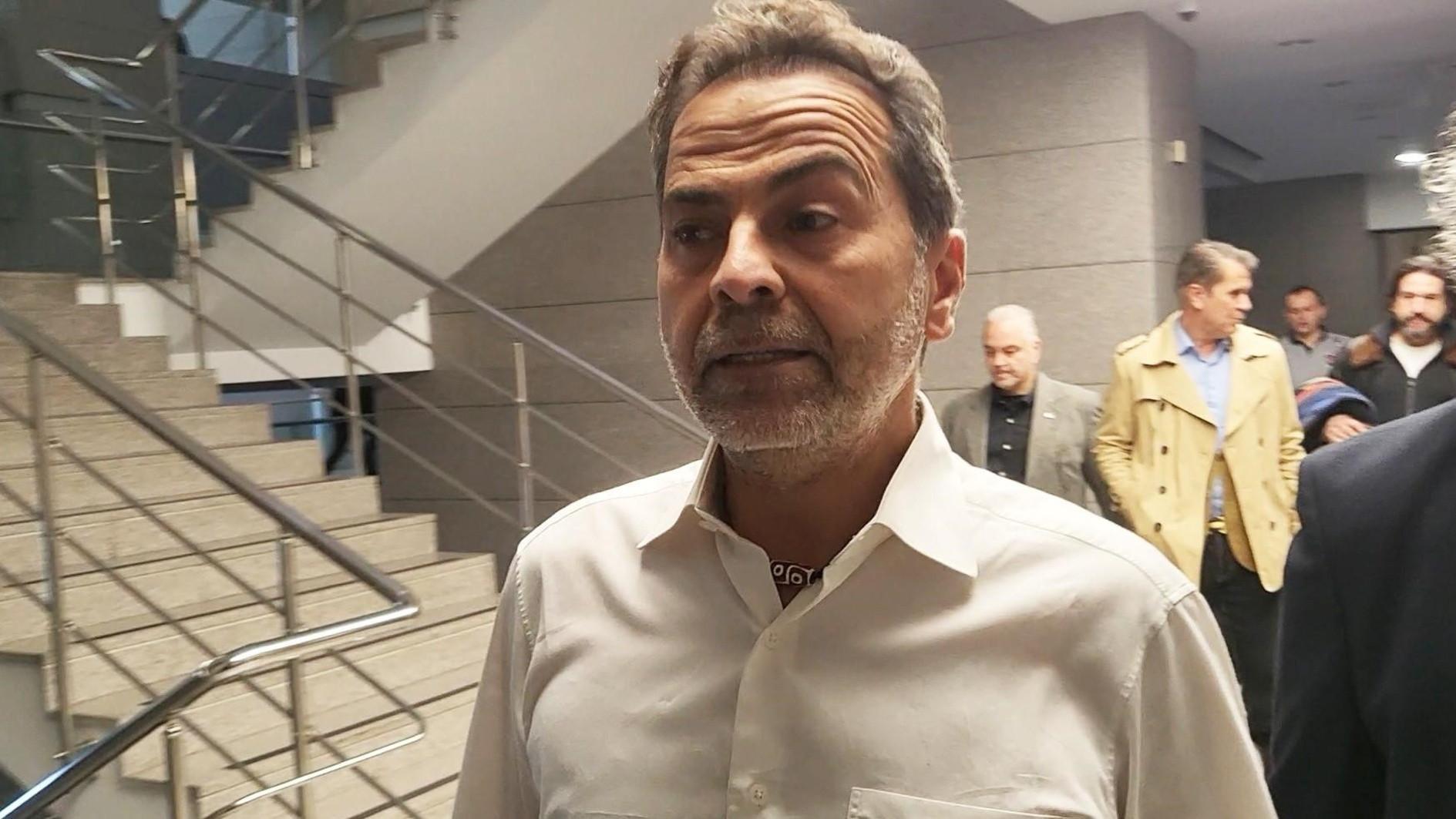

"There are European governments that have contacted me to ask if I could sell factories to Chinese companies," Carlos Tavares, director general of Stellantis [Peugeot, Fiat, Opel] said yesterday.

If the Chinese capture 10 percent of the European market, then "mathematically there are seven or eight factories that would close or be transferred to the Chinese," he said while visiting a factory in the east of France.

Stellantis has started making small electric cars for its Chinese partner Leapmotor in a Fiat factory in Poland.

At the same time, German brands fear a severe backlash on their sales in China, which represent a significant part of their profits.

And the Chinese government has retaliated by imposing tariffs on other European sectors, such as brandy producers.