Banks should take risks: Association

ISTANBUL - Anatolia News Agency

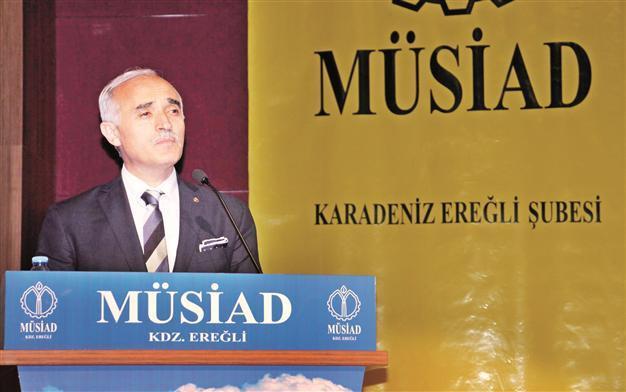

MÜSİAD President Nail Olpak. DHA photo

Banks in Turkey should move to a system in which they will not only give secured loans, but also loans to projects, the president of the Independent Industrialists’ and Businessmen’s Association’s (MÜSİAD) said yesterday, stressing that the banks should take more risks.“We are not in conflict with the banks, but they should stop giving only secured credits, they should take some risks, which is in the nature of commercial life,” said Nail Olpak during a press meeting where the 2013 Turkey Economy Report was announced.

Olpak stated that banks should grant more loans for projects, with public banks focusing on investment banking activities as well as deposit banking. “The banking system should be encouraged for project financing. The public projects should be divided into financeable parts and widen the base during realizing these projects, it should pave the way for medium-sized companies in energy investments,” he said.

Olpak stressed that small size companies were not able to take place in giant projects, but if the medium sized companies joined these projects it would lead to prosperity being expanded to the base.

He added that in big portfolio privatizations, a gradual share transfer method might be considered instead of the block sale of public shares, stressing that public-private sector cooperation should be more effective than it currently is.

After a question asking whether they had taken into account the recent decision of the U.S. Federal Reserve (FED) to end its asset purchases in 2014, and the Gezi Park incidents, Olpak said they prepared the report by considering the recent data in June.

“We think that the growth rate will be around 4 percent despite all these incidents. The unemployment rate will stay at between 9 and 9.5 percent. We anticipate inflation will stay at 6 to 6.5 percent,” he said.