Bank burns reserves to defend lira against dollar

ISTANBUL - Hürriyet Daily News

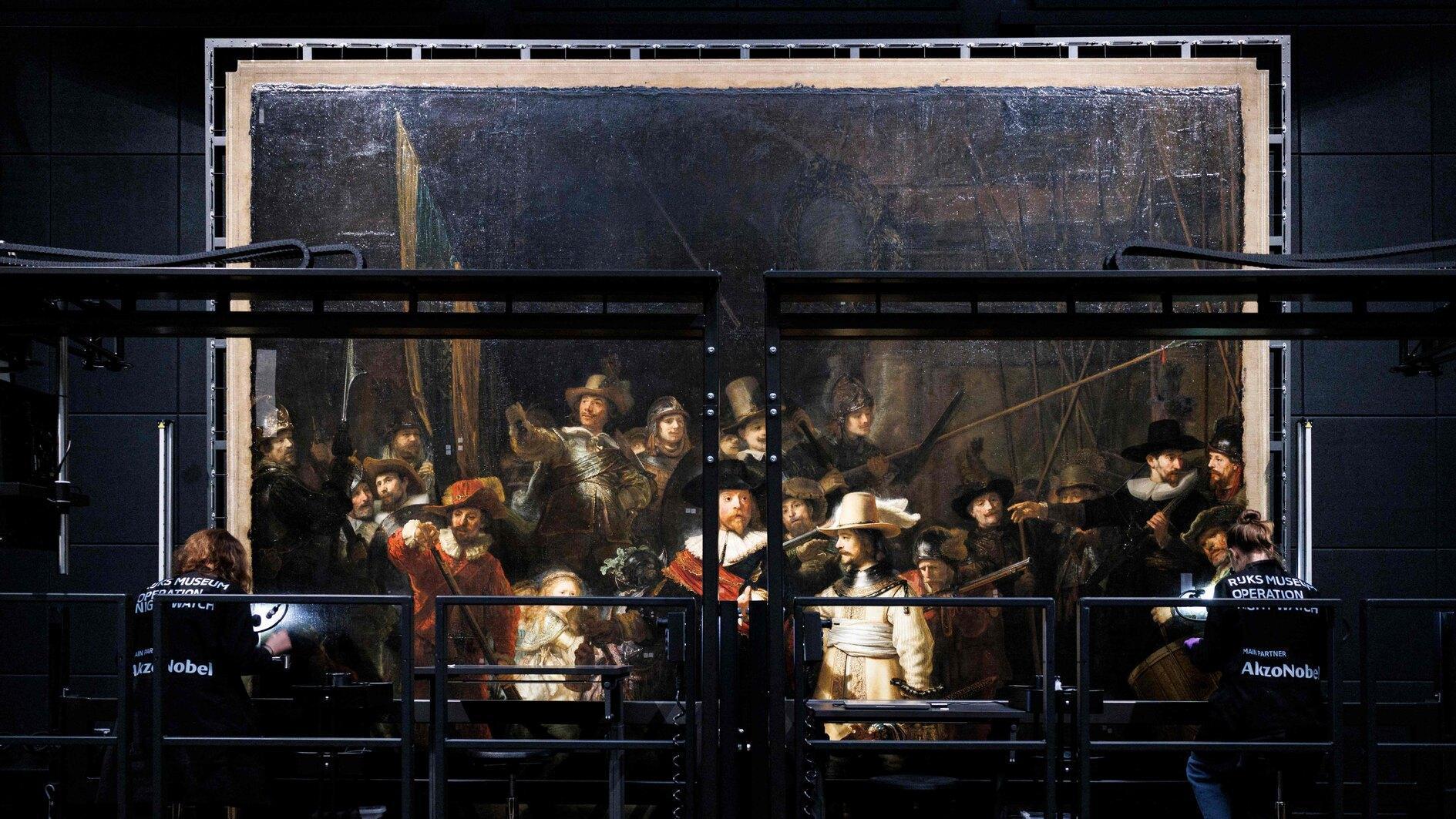

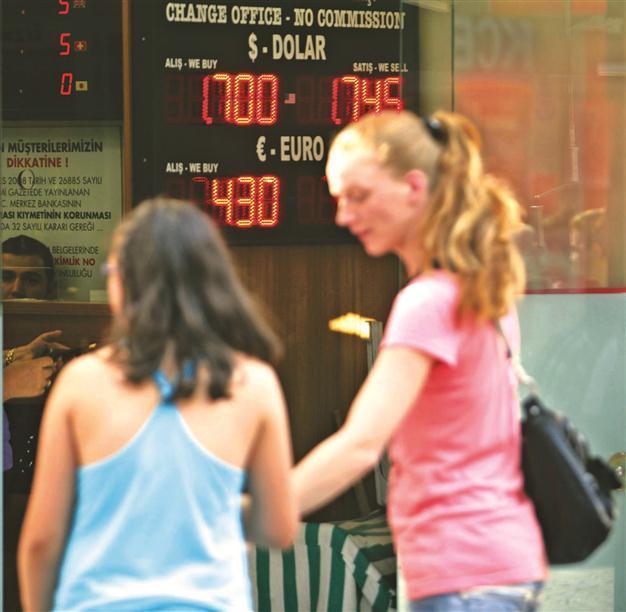

Pedestrians walk past an exchange office in central Istanbul in August last year when the Turkish lira was trading at around 1.7 per dollar. On the first trading day of the new year, the local currency was trading at nearly 1.89 per dollar. Hürriyet photo

The Turkish Central Bank, which employs a much-debated strategy of low interest rates, has surprised the markets on the first trading day of 2012,intervening massively in the currency markets. The intervention came days after the Bank sold around $3 billion in a single day on Dec. 30.

As the Hürriyet Daily News went to press yesterday, the U.S. dollar was trading at 1.89 Turkish Liras, barely under the 1.92

record which was broken in the final days of December – indicating that the frantic dollar selling was having little effect at a time when investors worldwide seek the safety of the greenback.

Yesterday’s selling was estimated at somewhere between $500 million and $650 million.

“The Central Bank is preparing for a major hike in the dollar against the lira,” said economist Emre Alkin, warning that one dollar could trade at 2 liras soon. “[The current] dollar selling is more aimed at the future. If the dollar rises above 2.1 liras, it would have disastrous results for the economy,” Alkin said, reminding of Turkey’s high dependency on oil and gas imports.

The lira fell to a record 1.9224 per dollar last week on concerns that the current monetary policy will fail to contain a burgeoning current-account deficit and accelerating inflation, Alkin said, adding that Central Bank reserves are not sufficient enough to use this instrument often.

Worrying depreciation

Turkish Central Bank reserves, including gold, total around $88.2 billion after yesterday’s intervention. The lira lost around 22 percent against the U.S. dollar in 2011, becoming the worst performer against the greenback. Even the battered euro gained 19 percent against the lira last year.

A Central Bank statement said the previous intervention on Dec. 30 was triggered by “unhealthy price formations.” The Bank sold $750 million in an auction that day, but deepened its intervention by selling as much as $1.5 billion on top of that.

Twitter was also buzzing after the news of the intervention broke. Murat Salar said the Central Bank should “reach concrete results” or “serious trouble” looms ahead. Money market trader Şükrü Haskan said Gov. Erdem Başçı “behaves like a trader.”

“It is time for the Bank to leave its unorthodox policy and shift to a simple policy,” said Serkan Gönençler, an Arma Portfolio economist. “The current [policy] fuels confusion about further steps from the Bank and leaves little space to maneuver, as dollar reserves are insufficient,” Gönençler told the Daily News. He urged a hike in the benchmark interest rate, instead of the current “interest rate corridor” policy that has confounded market players.

“Exchange rate pressures will not be mitigated with [dollar selling],” said İnan Demir, chief economist at Finansbank. The intervention might look successful in spurring a slight appreciation of the lira, but it is unsustainable in the long run, Demir told the Daily News. The economist said the nation’s outstanding foreign debt due to mature in 12 months stands at $136 billion, thus pointing toward a concrete reason why the market is gobbling up dollars.

Gökhan Kurtaran from Istanbul contributed to this report