As growth slows in Turkey, unemployment climbs

MUSTAFA SÖNMEZ - mustafasnmz@hotmail.com

The Turkish economy, which shrank after the 2009 global crisis, recorded 'miraculous' growth rates at an average of 10 percent in 2010 and 2011. Then came low growth years: In 2012 the economy grew around 2 percent, while in 2013 it grew 4 percent. DAILY NEWS photo

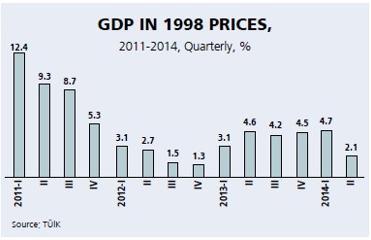

Turkey’s growth rate, which had been estimated by official and private institutions and organizations to be around 3 percent for the second quarter of 2014, has been announced at 2.1 percent - below expectations. This amounts to a notable slowdown in the growth tempo. As a natural consequence of this, seasonally adjusted unemployment has seen an upward alteration; unemployment is rapidly escalating. This trend is not unique to the second quarter either, as a series of indicators suggest that a similar course will be seen in the coming quarters.

The Turkish economy, which shrank after the 2009 global crisis, recorded “miraculous” growth rates at an average of 10 percent in 2010 and 2011. Then came low growth years. In 2012, the economy grew around 2 percent, while in 2013 it grew 4 percent. The target for 2014 is 4 percent, but growth in the first six months of the year was only 3.3 percent: 4.7 percent in the first quarter and 2.1 percent in the second quarter. Cabinet ministers have also accepted that the targeted 4 percent growth was too ambitious and a revision is necessary.

From exports…

From exports… The biggest contribution to the second quarter’s 2.1 percent growth rate came from the export of goods and capital. While the contribution from private and state consumption was a total of just 0.6 percentage points, the decline in investments also had a negative effect. The “Gross Capital Formation,” made up of the government and the private sector’s investments, dropped 3.5 percent, contributing the most important negative effect on growth. Especially the private sector’s investments have come to a halt.

The biggest contribution to the second quarter’s 2.1 percent growth rate came from the increase in the added value of exports of net goods and services. The added value created in exports of tourism, international construction and international transportation was the main competent of growth, with a 2.8-point contribution.

Domestic demand A significant factor in the drop of the growth rate was the shrinkage in domestic sales and investments. High interest rates and the hike in foreign exchange rates had an effect in this result. With the decline in demand for housing, white goods and automobiles, the growth in the domestic market also shrank.

External sales, on the other hand, both due to the recession that Europe is still experiencing and also the increasing geopolitical risks and war in the Middle East, could not open a field of growth. This whole situation has considerably slowed down production wheels.

When viewed according to sectors, it can be seen that agriculture declined nearly 2 percent - a result of draught and other climatic circumstances. While 7 percent growth was recorded in mining, growth in the manufacturing sector stayed at 2 percent. As a result of the fall in domestic sales, growth in trade was limited to 0.3 percent. In the “star” sector of the period, the construction sector, average growth was exceeded by just half a percentage point, becoming 2.6 percent.

It doesn’t seem possible that Turkey’s unsuccessful growth performance will shift to a positive tempo in the third and fourth quarters of this year. Interest rates, which cannot be lowered due to inflation rates approaching two digits, are pressuring both investments and domestic demand, and it looks like growth will remain below 3 percent on an annual basis in the coming quarters.

Climb in unemployment

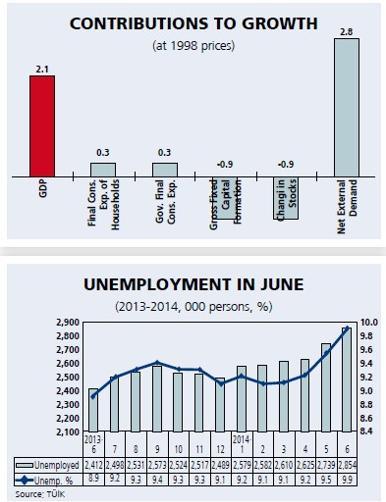

Climb in unemployment The low growth of the second quarter has been reflected in the increase in unemployment. The rate of unemployment for June (seasonally adjusted) has been released by the Turkish Statistical Institute (TÜİK) as 9.9 percent. Non-agricultural unemployment in June, however, has reached 12 percent; youth unemployment is 18.1 percent.

When viewed from the annual basis, general unemployment has increased by 1 point in 12 months, from 8.9 percent in June 2013 to 9.9 percent in June 2014.

On an annual basis, the number of unemployed has gone from 2,412,000 to 2,854,000, an increase of 442,000. It is noteworthy that a little over a quarter of this increase occurred only in the month of June.

When non-agriculture unemployment is viewed, the 10.8 percent rate of June last year increased by 1.2 points this June, to reach 12 percent. In the May-June period of this year it increased by half a point.

Unemployment among those aged under 24 has increased 1.4 points in 12 months, from 16.7 percent to 18.1 percent.

These are alarming dimensions.

Decrease in employment In June of this year, 20,000 people joined the workforce but were unable to find jobs, while some 96,000 people who had jobs have also lost their jobs. The June employment data (seasonally adjusted) show that there has been an employment drop of 72,000 in agriculture and 32,000 in industry. In June, the employment drop in the construction sector was 54,000, meaning that the number of workers in the sector dropped to 1,800,000.

Despite the drop in agriculture, industry and construction, employment in June in the services sector increased by 62,000. But, at the end of the day, the net employment loss was nevertheless 96,000. With the addition of the 20,000 who joined the workforce in June but were unable to find jobs, some 116,000 people were added to the army of the unemployed; thus increasing unemployment to 9.9 percent.

Investments halted What was effective in the rise of unemployment was the 3.5 percent drop in investments in the second quarter, the fall in production capacities, and the draught experienced in agriculture.

Growth data in the second quarter showed that there has been a decline in investments of up to 7 percent, particularly in machinery-equipment investments, while there was a 3 percent increase in construction investments. The fall in domestic demand, primarily in the construction, automobile and white goods sectors, has forced businesses to stock and, if the stocks are full, to lower capacity and trim employment.

It is highly probably that the problem of low growth, generating unemployment, will also be experienced in the coming quarters. It looks inevitable that official unemployment will be announced as being in two digits as of July, and that the year will close with at least 11 percent general unemployment and 13 percent non-agricultural unemployment.

From exports…

From exports…  Climb in unemployment

Climb in unemployment