Another Aegean brand ends after acquisition

Nazlan Ertan - nazlanertan@gmail.com

Last week’s announcement that Kipa had agreed to sell 95.5 percent of its shares to Migros marks the second major deal Migros realized in the Aegean market in just over a decade.

Last week’s announcement that Kipa had agreed to sell 95.5 percent of its shares to Migros marks the second major deal Migros realized in the Aegean market in just over a decade. In business terms, the deal gives Migros a major push in one of the fastest-growing regions in the country and enables international retailer Tesco to leave the Turkish market.

But in the eyes of sentimental locals in the Aegean province of İzmir, the sale means the end of a second İzmir-born brand in retail.

“Both Tansaş and Kipa, İzmir-born retail companies now bought by Migros, were born out of the initiative of forward-thinking İzmir businessmen… We created them, grew them and then they were taken by national and international business – and their names are unlikely to go on,” wrote Dilek Gappi, a columnist for HaberTurk Ege.

“We will tell our children that once there was Tansaş and Kipa and local businessmen taking initiative… Why do İzmir brands fail to survive and grow on their own?”

There are many replies to that, which range from fierce global competition to the rise of discount stores. Sarcastic outsiders also quip that “İzmir would do anything for their local brands, except buy them.” The truth may lie in a combination of all three, but the fact remains that the two retail models that were initiated and developed by İzmir business circles in the 1990s failed to survive on their own into the 21st century and their names are unlikely to go on.

A tale of two businesses

Both Tansaş and Kipa had similar establishment stories. Tansaş, which is an abbreviation for “Ordered Sales” (Tanzim Satış), was established under the roof of the İzmir Municipality. It was privatized and bought by Doğuş Holding and then sold to Migros in 2003, when Migros’ majority shares were still held by Koç Holding. Gappi’s lament on “lost brands” comes in the wake of the rebranding of Tansaş stores in İzmir as Migros after Anadolu Holding acquired a 40.25 percent stake in Migros in July 2015.

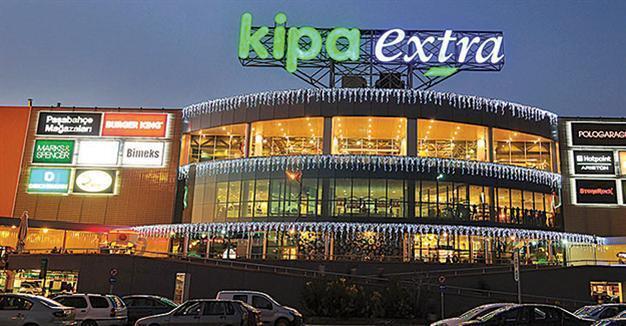

Tansaş’s first general manager and the future mayor of the city, Ahmet Priştina, used his experience in modern retail to help create “Ki-Pa,” whose name meant “mass retail.” In 1994, Kipa opened its first supermarket in Bornova, İzmir. In less than a decade, it was sold to international retailer Tesco, in 2003, with a good return for investors. With Tesco investment, the number of stores, which maintained the name Kipa, reached around 180. Kipa also entered into the shopping mall sector and had around 30 malls, including its flagship mall and store Kipa Çiğli in İzmir. It also bought stores from a local chain in Thrace, strengthening its presence there.

Yet, the Tesco Kipa efforts to “take” Istanbul and Ankara fell short. Tesco and Kipa strategists came to the conclusion that the brand was stronger in its heartlands – the Aegean and the newly-strengthened Thrace - and looked for ways to sell or close away the “costly parts,” such as Central Anatolia.

Rumors about a tripartite deal with Migros and Anadolu Holding came out in 2014, at a time that Tesco was closing down its unprofitable businesses around the world and had already moved out of Japan and the United States. Anadolu Holding, for its part, was looking to expand beyond beverages as well as secure retail for its beverage and fruit business. As news came out that Anadolu would be buying shares in a combination of Migros and Kipa stores, parties admitted that there were “talks on different options with different partners.” Shortly, Kipa announced those talks had come to an end. Several months later, Anadolu announced it had bought 40.25 percent of Migros Ticaret AS in a transaction which valued the second-biggest Turkish retailer at 6.4 billion Turkish Liras ($2.7 billion).

Tesco’s time to cut losses

With the change of CEO from Phil Clarke to Dave Lewis, or “Drastic Dave,” Tesco appeared more inclined than ever to reduce costs, focus on core interests and sell parts of the business that did not make a profit. Strict cost-cutting measures, combined with peripheral asset sales, aimed to stop the hemorrhaging in Tesco. In Turkey, Kipa closed nearly 20 stores in one year and made severe reductions in its personnel. It also worked on a deal to send its Central Anatolian stores to Beğendik but the deal did not come through. While the costs had fallen seriously in the last 18 months, the Kipa business was still far from making a profit or breaking even. In the last financial report, Kipa posted a net loss of 574 million liras in the 2014-2015 financial year.

When the deal with Anadolu Holding was announced, very few people in business circles were surprised. “The sale of Kipa reflects the particular strategic challenge we have faced in Turkey as a small regional player in a highly competitive market,” said Lewis. “It removes the need for the sustained investment required to enable the business to compete independently.” The statement made no reference to the political atmosphere in Turkey.

The sides announced to the Istanbul Stock Exchange that the transaction would be subject to regulatory approval. Financial experts say that Migros’ acquisition of 168 stores, most of which are in the Aegean, would be subject to any objection of a monopoly in the market.