Turkey faced with Russian winter in trade and tourism

And not because almost none of those contains rigorous statistical analyses. I fiddled with econometrics in a column back in October and found the impact of lower oil prices on inflation, the current account, and growth to be smaller than expected. But you cannot expect everyone to have mastered the science and art of econometrics – I definitely do not claim to. However, not much common sense has gone into these analyses, either – and there is no excuse for that.

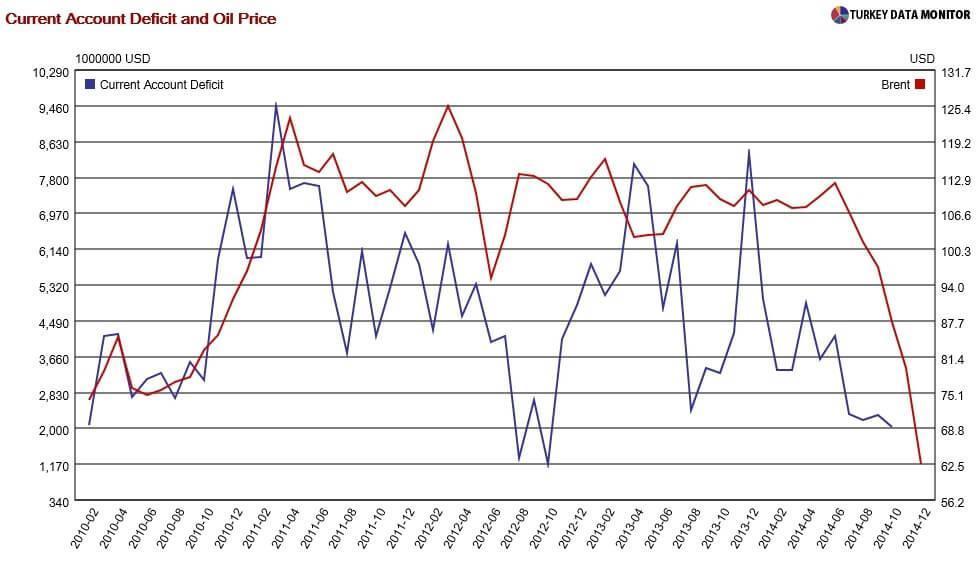

Take the impact of oil prices on the current account deficit. The rule of thumb every Turkey economist seems to parrot is that a one-dollar fall in oil prices reduces Turkey’s current account deficit by roughly $400 million. This law has held so far because the amount of energy Turkey needs to import is more or less fixed. But what would happen if oil prices fell so much that the economies of oil producers who import goods from Turkey were disrupted?

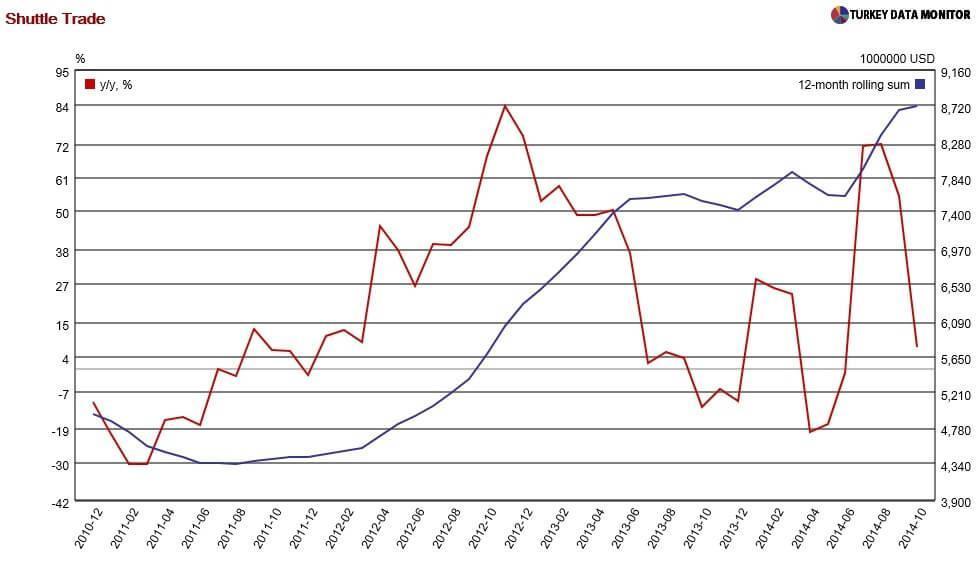

According to the latest Balance of Payments (BoP) statistics released on Jan. 13, the current account deficit turned out to be $5.6 billion, somewhat higher than the expectations of $5.2 billion, in November. Almost all Turkey economists singled out higher-than-expected gold imports as the primary culprit. Since it is a tiny drop compared to other parts of the BoP, the 4 percent annual drop in shuttle trade did not get much attention.

But since most of the shuttle trade is with Russia, the fall should be taken as a harbinger of maladies. In fact, exports to Russia have been plunging around 20 percent annually for the last three months. While the decrease in exports to them is nowhere near, a similar story could be told for the other oil producers Turkey sends goods to.

Then, there is tourism. Even though the number of tourists from Russia decreased 18.5 percent annually in November, the total number of tourists and tourism revenues rose 1.2 and 1.5 percent respectively. This is because Russians come to Turkey mainly for sea, sun and fun. But with their economy expected to contract this year, major Turkish tourism destinations like Antalya that rely heavily on Russians are bound to be affected this summer.

If hotels cannot make a profit, they cannot pay their suppliers, and if their suppliers cannot get paid… I guess you get the picture. In fact, seasoned journalist (and fellow Beşiktaş fan) friend Tarık Yılmaz recently published a couple of articles at his manset.at website, where he argued that firms in Antalya are already facing financial difficulties.

If you followed all of this, you managed to understand the difference between general equilibrium analysis, which studies several interacting markets, and partial equilibrium, which looks at just one market. You now know more economics than a good chunk of the Turkey analysts out there.