Surely you’re joking, Mr. Babacan!

The end-year inflation projection of 6.8 percent is a significant upwards revision from the 5.3 percent in last year’s MTP, but it is still unrealistic. In fact, even market expectations of 7.4 percent may be optimistic, especially because the Central Bank has committed to not hiking rates further.

While this year’s forecast is practically impossible to meet, next year’s projection of 5.3 percent is a practical joke for anyone who would plan their business on it. The stickiness in inflation dynamics, which became apparent in September inflation, as well as the lack of a nominal anchor in the monetary stance and framework, as the IMF noted in its latest report on Turkey last week, should prevent a meaningful decrease in inflation.

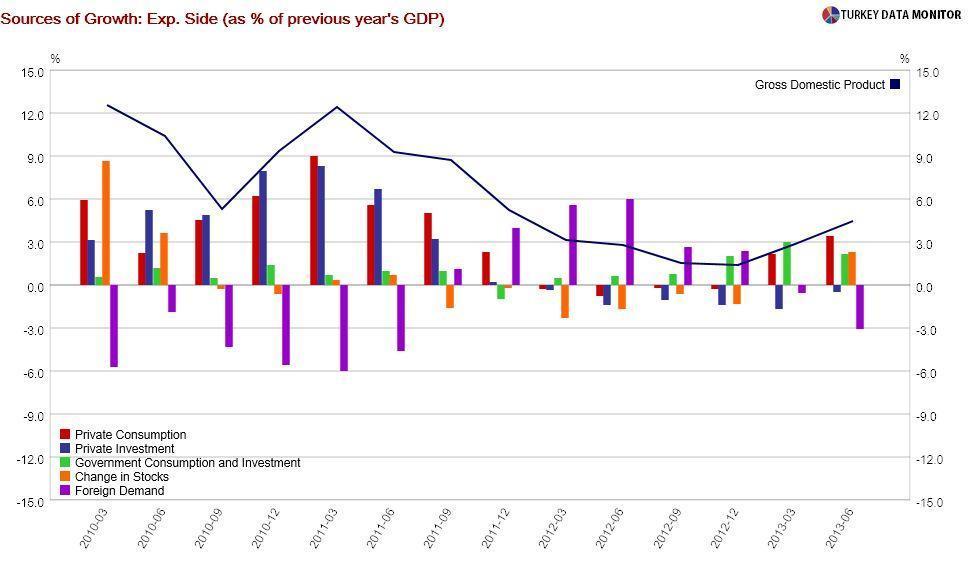

Growth forecasts are marginally better. The 3.6 projection for this year is realistic despite some recent signs of a slowdown in the pace of economic activity. After all, the economy grew 3.7 percent in the first half of the year, and leading indicators are pointing to a third quarter growth of over 3.5 percent.

On the other hand, next year’s forecast of 4 percent is not. For one thing, Turkey depends on external financing for growth, and despite the government and the Central Bank claims otherwise, capital is unlikely to be as abundant as before once the Fed starts tapering its bond purchases. Besides, the 0.8 percentage point contribution from external demand assumed in the MTP is incompatible with this growth rate.

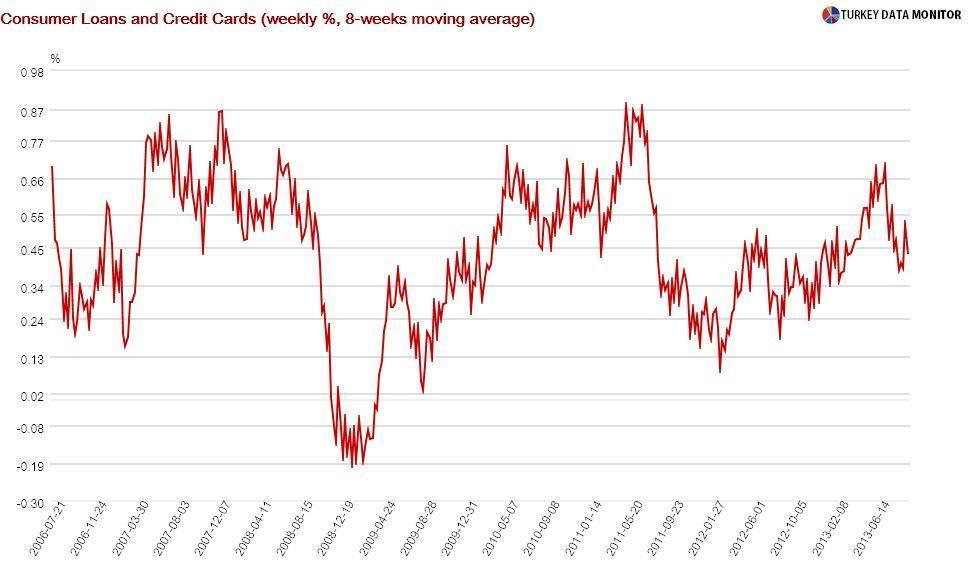

Moreover, the government is well aware that credit growth is fueling the country’s current account deficit, and so Babacan revealed measures to stem growth in consumer loans and credit cards. While this is definitely a welcome development, it also means the contribution to growth of private sector demand will fall.

This leaves government spending, which contributed significantly to growth in the first half of the year. Non-interest expenditures remain high in the MTP, and we could expect some breach of the targets as Turkey heads towards triple elections. But I doubt that pork barrel spending will be enough to keep growth at 4 percent.

As for the current account deficit, I am OK with this year’s projection of 7.1 percent of GDP. In fact, the deficit could come in lower if the economy slows down as I am expecting. Next year’s forecast of 6.4 percent makes sense as well. However, with the economy projected to grow at 5 percent in 2015 and 2016, I just cannot see how the deficit would fall to 5.5 percent by the end of 2016, even with the low oil prices assumed in the MTP.

The government continues to believe in their dream scenario of “triple five”: Five percent inflation, growth and the current account deficit. If only they based their hopes on sound policies rather than global developments beyond their control.