Monetary policy’s ‘Groundhog Day’

For my last column, I calculated the real effective exchange rate (REER) to be 122.6. Since Governor Erdem Başçı had revealed on Nov. 12 that they would see a REER above 120 as over-appreciation and then react, I was not too surprised when the Bank cut its borrowing rate by 25 basis points (bp). By lowering the floor of the corridor, the Bank is hoping to discourage some of the hot money coming to Turkey and prevent lira appreciation.

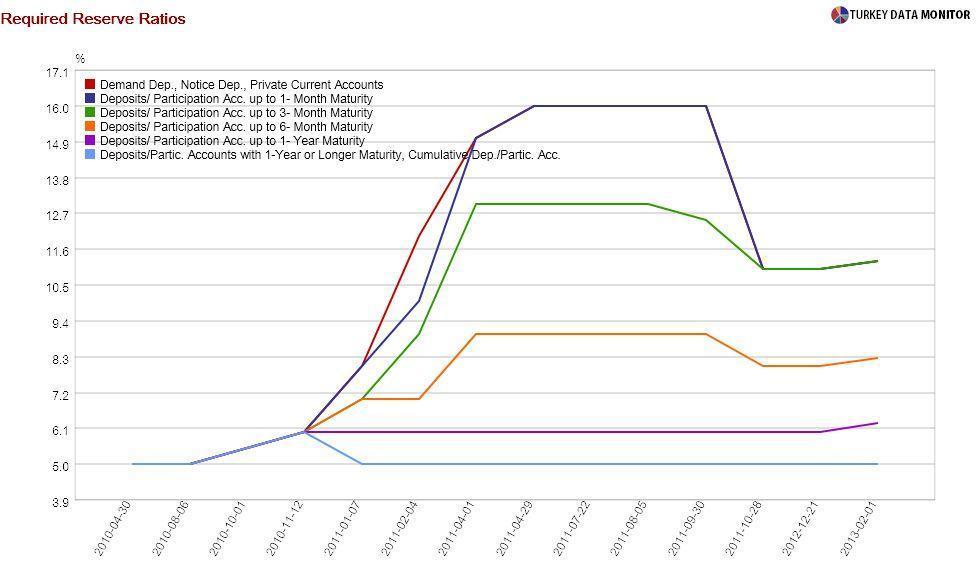

To combat excessive credit growth, the Bank hiked required reserve ratios (RRRs). These actions may ring bells: The Central Bank applied the same policy mix of lower rates and higher RRRs in 2011. Therefore, as Murat Üçer of Turkey Data Monitor noted, Jan. 22 was monetary policy’s “Groundhog Day,” referring to the movie where Bill Murray gets to live the same day over and over again.

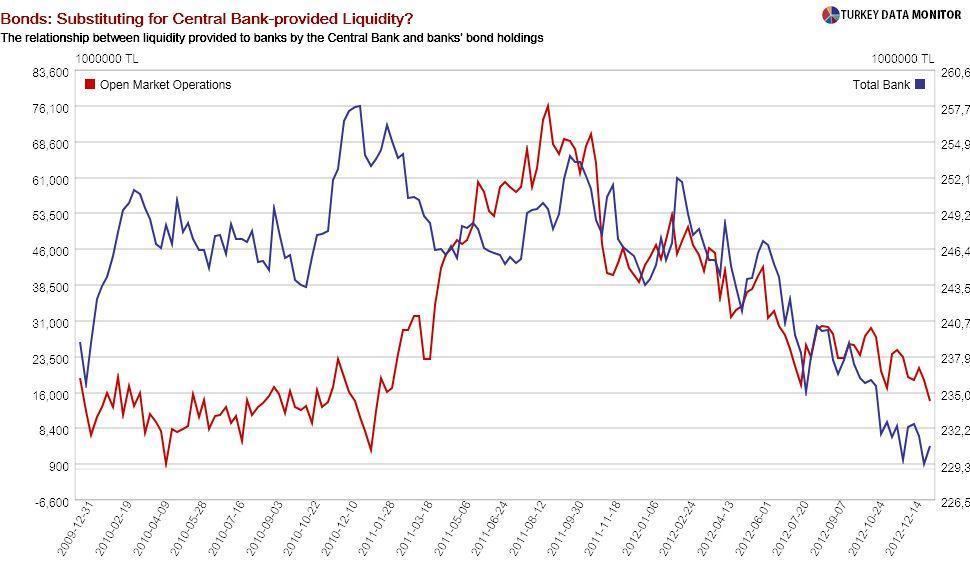

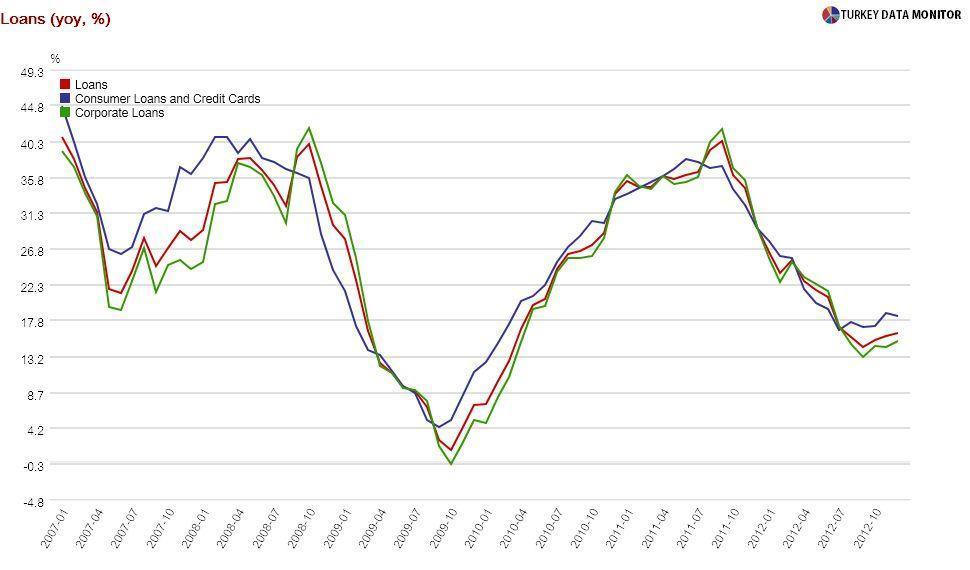

This mix looks exemplary, but things are not that simple: Credit growth did not slow down back in 2011 until the banking regulator saved the day in June with its own set of macro-prudential measures. Üçer explains that “banks largely ignored the cost channel and were not particularly intimidated by the liquidity channel”. After all, they can switch from government bonds to loans in a low interest-rate environment if the Central Bank starts tightening liquidity. 2011 was case-in-point.

But why did the Bank lower its lending rate, the ceiling of the corridor, 25 bp as well if it is worried about credit growth? After all, that rate is a reference for banks’ loan pricing. But as the Bank’s chief economist Hakan Kara noted in their regular meeting with economists yesterday, the lending rate is more relevant for commercial loans, which are not growing as fast as consumer loans.

He also remarked that they would like to decrease the commercial loan-deposit spread, which is around 4 percentage points. In any case, the Bank’s effective funding rate for commercial banks, at 5.6 percent, is much lower than its lending rate, and so the ceiling is not binding at the moment.

As for the one-pager accompanying the rate decision, it seems the Bank expects a significant pick-up in economic activity this quarter. Kara cited the increase in real sector confidence to support this view, and so I expect a strong reading when the Central Bank releases the January figure for that statistic today.

What about inflation, the Bank’s main responsibility? It seems policymakers will try to take care of it by manipulating expectations: speaking at Davos yesterday, economy tsar Ali Babacan and Başçı noted separately that the Central Bank’s 5.3 percent end-year inflation target had taken the recent tobacco tax hikes into consideration.

If I didn’t know any better, I would have asked them to send me some of the stuff they were smoking before they spoke. In any case, this seemed rather smoky to me.