Assembling increases in Turkey’s industry, lowering internally generated production

Mustafa Sönmez - mustafasnmz@hotmail.com

The ideal is 100 percent vertical integration but this exists in low dosages in reality and the supply chain is provided by different local and foreign companies. Thus, the product is produced with the new contribution of workers, constituting a link in the local and international division of labor.

International powers’ equilibrium determines which link the company will hold and how strong and effective it will be. The “central” powerful active factors while they keep the most valuable and most profitable stages of the chain to themselves leave the low profit one to “periphery” countries. This unequal division of labor is carried out with the directives of dominant components and with the compromise and submission of periphery country companies.

Being the weakest link in the product chain brings together the production of low-added value, low profitability, low employment and low salaries.

Turkey, the weakest link

The industry of Turkey cannot overcome the state of being the low-added value producer in the global chain; it cannot become one of the more powerful, the more value producing ones and the actor with more share of the value. While foreign contributions dominate in the products produced and sold by the industry, it cannot even reach one third of the sales incomes; two-thirds of sale income are spent for the purchase of machinery and equipment, intermediate goods, semi-manufactured goods and energy required for the production; the added value produced in the company does not show any notable increase.

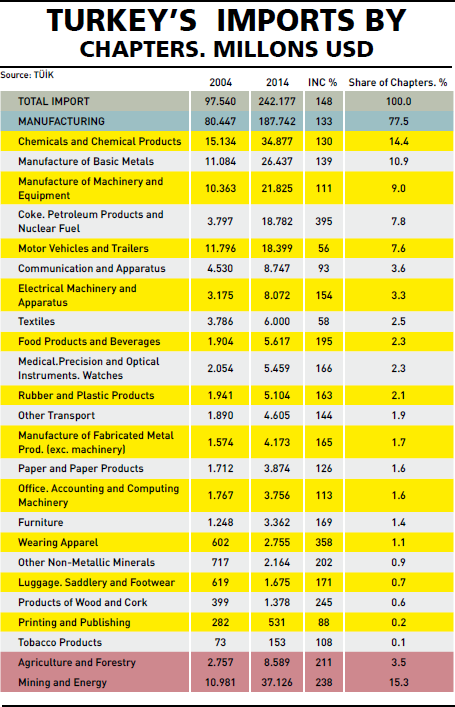

For instance, in 2004, an import worth of $97.5 billion was made corresponding to 25 percent of that year’s national income. In 2014, this figure has exceeded $242 billion, more than 30 percent of the national income.

The importation of products from machinery and equipment, along with raw material and other inputs in the manufacturing industry, have gone up from $80.5 billion to $188 billion, increasing 133 percent. Chemicals and chemical products, scrap iron, machinery and equipment, coke, petroleum products, motor vehicles, communication apparatus, electrical machinery, textiles, food products and beverages are leading imported items.

Besides some finished products, semi-finished, raw material and products important in pieces have been sold in the domestic market. This situation has lowered the share of the local gross-added value in the total sales of industrial companies, consequently, restricting the rise in employment.

In 2014, the share of the created added-value in the Turkish industry in their sales is less than 30 percent. In sales of industrial firms, the contributing share of the company is even lower than one third. In certain important sectors, this share drops to 15 percent.

Among the Istanbul Chamber of Industry’s (İSO) “Top 500 Industrial Firms,” according to my survey of gross-added values of 255 firms, the rate of vertical integration in the top 255 companies reached barely 30 percent in 2014.

According to İSO’s top industrial firms’ data, the net sales incomes of these 255 firms reach 272 billion Turkish Liras; 354,000 workers employed by these firms produce a value of almost 81 billion liras and the contribution is around 30 percent.

Decline in 2000s

It is the reality of the 2000s that the internally generated company production share in the sales of industrial firms has gone down to 30 percent. In a study titled “Development Trends of 500 Top Industrial Firms-10 years (2001-2010),” this reality is highlighted.

Big firms produce mostly based on exportation. The share of exports in total sales at the period between 2001 and 2010 is around 27.5 percent as annual average.

The industrial sector is producing mostly based on assembling. The fact that the rate of gross-added value to sales revenue remains around 31.7 percent shows that the production is mostly assembling.

Sectors and production shares

The data, when viewed according to sectors, shows that the highest local production shares belong to mining and “defense,” and cement and glass sectors, while the lowest ones are gold-jewelry processing, leather, wood and food products.

Result

Especially after 2003, the preference of companies of importation and outsourcing under the circumstances of low foreign exchange rate and cheap loans has provided temporary profits for companies but they have become more of an assembler, a packager which in turn has lowered the quality of employment and weakened innovative, inventiveness tendencies.

Also, it has furthered the country’s current account deficit, reinforcing its fragility and increasing the outstanding external debt to giant dimensions, and increased the cost of refunding dangerously.

The unsustainability of this situation has been bitterly noticed with the hike in foreign exchange rates and the rise in the cost of external loaning. To overcome this problem, a series of micro and macro policy changes have to be made.

At the macro level, a more realistic foreign exchange rate policy and a resource using rationality as well as foreign trade measures that would protect the industry from destructive foreign competition are required.

Local input, energy production and supply should also be encouraged; the added value contribution internally generated within the company should first be increased to 30 percent, then 40 percent and then 50 percent with public support. All of this requires changes in industrial policies and strategies.

In parallel with this macro advance, which would mean the locomotive power for re-growth, it is also necessary that sectors and firms make their own micro changes to increase productivity, should be engaged in innovative and inventive efforts and try to increase their added value rates.