Alcohol consumption in Turkey not diminishing despite obstacles

MUSTAFA SÖNMEZ

Rakı prices have jumped by 272 percent since the beginning of 2004. The price increase of beer is not far below at 218 percent, while wine is 163 percent. Hürriyet photo

Turkish Deputy Prime Minister Bülent Arınç recently objected to a local singer singing a folk song, as the song contained the word “rakı” in the lyrics. It was the song of a Balkan man complaining that he couldn't save enough money for rakı. Even though Arınç said he was joking, his behavior has been perceived as another example of intervention into people’ lifestyles and was criticized as such.

There have been moves against alcohol through taxes, area restrictions and neighborhood pressure over the last decade of Justice and Development Party (AKP) rule. This has been a more noticeable fact in Anatolian cities.

Still, the statistics reveal that alcohol consumption has not dropped radically and there is a formal production and sales as well as an illegal trade. In short, society is saying, “I won’t let you touch my drink!” and is holding out on bans. People propose a toast with rakı, or with wine or beer, which are more affordable for some.

Restraints through pricesThe AKP’s alcohol battle began with “area restrictions.” While Turkey’s current Prime Minister Erdoğan was mayor of Istanbul, an alcohol ban was imposed on the social facilities of the municipality. Then, the government intended to take action against the side streets in Istanbul’s Beyoğlu district.

Neighborhood pressure has run more rampant in Anatolia, where AKP-controlled areas have surrounded the businesses selling alcoholic drinks. Booze has also been removed from official parties and celebrations.

It's not only this. Alcohol sales hours and ads and commercials including beer and spirit brands have also seen new restrictions in recent moves.

However, the government has tried to lower consumption through the hiking of prices most of all. Since the beginning of 2004, inflation - namely the rise of consumer prices - is 113 percent, but rakı prices have jumped by 272 percent. The price increase of beer is not far below at 218 percent, while wine is 163 percent.

The AKP government has intervened in alcoholic beverage prices through taxes. When the collected Special Consumption Tax (ÖTV) increases, the producer reflects the hike in consumer prices. Alcohol taxes have been automatic, which means that as inflation rises the tax directly increases. There is no need to go too far beyond this. The ÖTV collected from alcohol, which was 3 billion Turkish Liras as recently as 2010, surged to 3.8 billion liras in 2011, and reached 4.6 billion liras in 2012. While the alcohol tax accounted for around 1 percent of the government's total tax revenues in 2006, last year its share approached 1.5 percent.

So it's not only in fuel taxes that Turkey holds the world record in ÖTV amounts paid by citizens. Alcohol consumers in Turkey pay three times more ÖTV than those in Sweden, which is often seen as the top tax-collector in the world.

Is there any decrease in alcohol consumption, despite price increases above inflation? The Tobacco and Alcohol Market Regulatory Authority (TAPDK), Turkey’s alcohol and tobacco regulator, doesn’t provide any data showing alcohol consumption dropping. There is an absolute rise, but there is also a need for sensitive calculations that consider the population increase and visiting tourists to really capture the real amount.

Anadolu Biracılık, the owner of Efes Pilsen beers, recorded a 1.1 billion lira turnover in 2012 in the face of advertisement and commercial bans and sponsorship obstructions. Particularly young consumers who can’t afford rakı are continuing to drink beer. With the spur of tourist visits, it seems that consumption isn't falling, but rather surging.

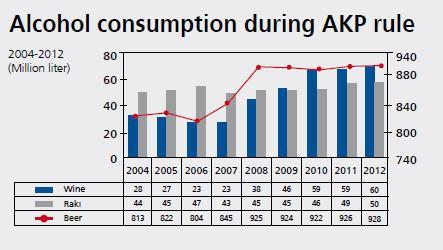

When viewed from a yearly basis, beer consumption amounted to 928 million liters in 2012, despite the 218 percent price rise in the past nine years, even though this momentum slowed down after 2008. Rakı consumption also soared to 50 million liters, from 44 million of nine years ago. Wine recorded the most remarkable performance, as its consumption is predicted to climb to 60 million liters, from 38 million liters, in the space of four years.

Restrictions also give rise to an illegal market for alcoholic drinks, as for tobacco. In addition to the entrance of smuggled beverages, in many parts of Anatolia, home-made rakı production is spreading under the counter. Some are producing for themselves, but some put these rakıs on the market. Meanwhile, holiday resorts serve beverages with cups to avoid taxes, which increases the possibility of counterfeit spirits. It’s risky and dangerous, but some take the chance.

2 local alcohol giants: Mey İçki and Efes Pilsen

Two large companies stand out in the Turkish spirits production sector.

The first of them is Mey İçki, the company which bought the alcoholic drinks section of state-run monopoly Tekel, a tobacco and drinks company. Mey İçki was founded by a joint venture of Nurol Holding, Özaltın İnşaat, Limak İnşaat and Tütsab.

The company, which constantly expanded its product portfolio since 2004, attracted foreign interest in a short time. In 2006, Texas Pacific Group acquired the majority stakes of Mey for a good price.

Tekel İçki was bought from the state for $292 million and after a name change into Mey İçki and undergoing some developments, it was sold to U.S. TPG for $810 million.

But even before five years passed after this sale, the TPG sold the Mey to British spirits maker Diageo for 3.3 billion liras.

So, the public’s rakı enterprise appears to have been transferred to a British company from an American one for 10-fold the amount paid to the state at the first purchase.

Operating in six categories, Mey is the top player in the vodka and gin markets in Turkey in addition to its leadership, by far, of the rakı market.

Efes PilsenWhen someone mentions beer, Efes Pilsen comes to people’s mind in Turkey and even in some neighboring countries.

Anadolu Efes, the fifth largest beer producer of Europe, has been consumed in more than 60 countries in the world. The owner of the Efes, Anadolu Endüstri holding, is also among one of the 10 largest capital owners in Turkey and is active in many sectors from automotive to energy, from heath to real estate and banking.