Al-Jazeera targets Spain amid dropping numbers in viewers

James M. DORSEY

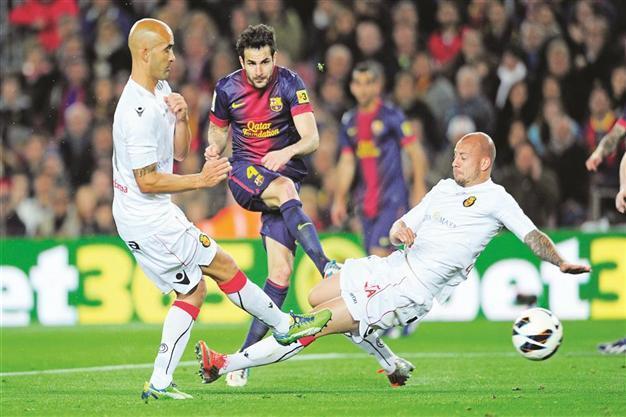

Barcelona midfielder Cesc Fabregas (C) shoots against two Mallorca players during a La Liga match at Camp Nou in Barcelona. La Liga is one of the most popular football leagues in the world. AP photo

Al-Jazeera is exploring the acquisition of Spanish La Liga rights in a bid to expand its global sports franchise, tweak its business model in a world in which pan-Arab television is on the decline, and compensate for mounting criticism of its coverage of popular revolts in the Middle East and North Africa.The state-owned Qatari television network’s renewed interest in Spanish rights comes as financially troubled Spain’s two major sports broadcasters, Mediapro and Canal Plus, which is owned by Grupo Prisa, struggle under a mountain of debt. It also follows a breakdown in talks with Rupert Murdoch’s media empire, according to Spanish news website El Confidencial Digital.

Grupo Prisa, with debts estimated at 3 billion euros, and Mediapro, with liabilities of 300 million euros, hinted last year that they would not bid at current rates for the Spanish league rights when the broadcast contract expires in 2016.

Al-Jazeera’s interest in the Spanish rights reaffirms its strategy of moving in behind other Qatari government institutions as they conclude sponsorship agreements and acquisitions, such as the winning of the hosting rights of the 2022 World Cup, the Qatar Foundation and Qatar Airways’ sponsorship of FC Barcelona, and the television network’s acquisition of French broadcasting rights in the wake of the Gulf state’s takeover of Paris St. Germain.

Focus on sports

It also fits Al-Jazeera’s move into markets such as Egypt, in anticipation that they will generate revenue at a later stage, and Qatar’s strategy of employing sports and media to leverage its global influence. Al-Jazeera last year launched belN Sports USA, and early this year purchased former U.S. vice president Al Gore’s Current T.V. to help the network’s penetration of the North and Latin American markets.

Al-Jazeera’s emphasis on sports, as well as its acquisition of local broadcasters such as Mubasher in Egypt, reflects changes in Middle Eastern and North African broadcasting. Al-Jazeera’s launch in 1996 revolutionized the region’s news broadcasting - which until then had been dominated by state-run broadcasters that towed the official line - with its free-wheeling coverage, debating of sensitive issues, and willingness to offend governments. As a result, it spawned the launch of a huge number of satellite television stations eager to grab a piece of the pie and make their mark.

It’s a strategy that has paid off. More than anything else, Al-Jazeera and the 2022 World Cup have put Qatar, a tiny city state, on the world map, allowing it to project soft power and engage in public diplomacy.

Nevertheless, Al-Jazeera, which experienced a boom as the primary news source in the heyday of the Arab revolts that toppled the leaders of Egypt, Tunisia, Libya and Yemen, has seen its viewership numbers decline recently with Arabs turning to local news broadcasters and a growing perception that Al-Jazeera is in bed with the Muslim Brotherhood and other Islamist groups, in line with Qatar’s support for them in various post-revolt countries as well as in Syria.

Market research company Sigma Conseil reported that Al-Jazeera’s market share in Tunisia had dropped from 10.7 in 2011 to 4.8 percent in 2012, and that the network was no longer among Egypt’s 10 most watched channels. Tunisia’s 3C Institute of Marketing, Media and Opinion Studies said that Al-Jazeera Sports was the only brand of the network that ranked in January among the country’s five most watched channels. Al-Jazeera reporters are reportedly increasingly harassed as they seek to do their jobs in Tunisia. Protests that erupted after this year’s assassination of prominent opposition leader Shukri Belaid charged that “Al-Jazeera is a slave of Qatar,” accusing it of biased reporting on the murder because of the Gulf state’s support for Ennahada, the country’s dominant Islamist grouping.

Complicating Al-Jazeera’s La Liga push is the fact that Spanish law requires one match a week to be aired on free-to-air, rather than pay, T.V. There is also the fact that each Spanish club sells its own rights, which strengthens the negotiating positions of teams like Real Madrid and Barcelona.

Grupo Prisa currently owns the broadcasting rights of Atletico Madrid, Celta Vigo, Espanyol, Getafe, Osasuna, Real Sociedad, Real Zaragoza, Athletic Bilbao and Real Betis, while Mediapro’s franchise includes Real Madrid and Barcelona. El Confidencial Digital reported that Al Jazeera was likely to revolutionize the $600 million broadcast market by acquiring La Liga’s rights as a package, with Mediapro acting as its broadcast sub-contractor, despite the opposition of Real Madrid and Barcelona.