Wolf in sheep’s clothing: Turkey’s consumer rebound

Recent Turkish data is hinting at an economic recovery driven by domestic demand, especially consumption, which is actually really bad news. I will explain myself, but let’s start with the facts:

The manufacturing purchasing managers’ index (PMI), which was released on Dec. 1, increased for a fourth consecutive month in November and is now at its

highest level since February. The improvement was broad-based, and while the increase in the output sub-index was marginal, the rise in forward-looking indicators, such as new orders, new export orders and employment, was significant.

Business channel CNBC-e’s

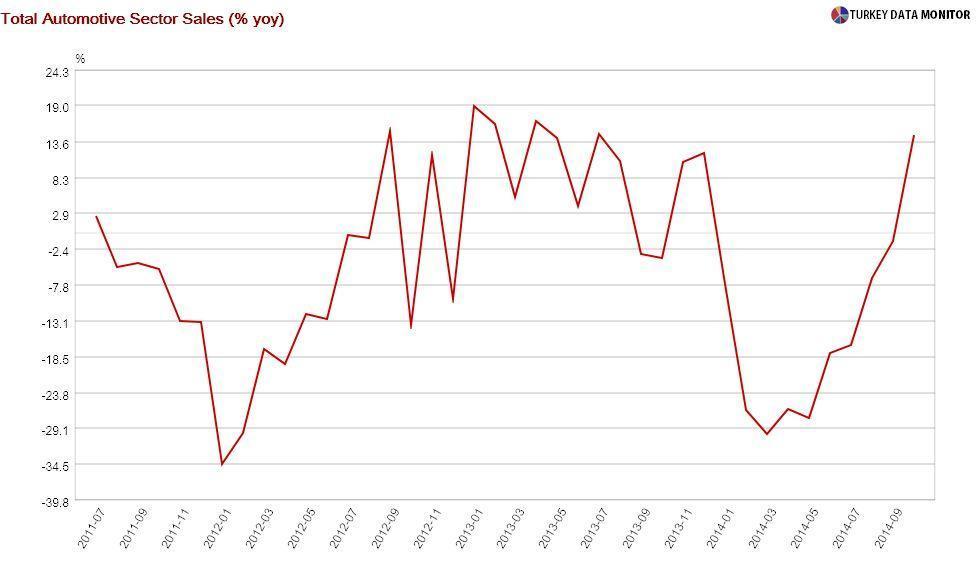

consumer confidence indices, which were released on the same day, confirmed this rosy outlook. The overall index increased mildly in November after having fallen for two consecutive months. The consumer sentiment sub-index, which measures the appetite for durable goods, rose for a fifth consecutive month. Sales of durables for which we have regular data, such as

automobiles and white goods, have indeed improved.

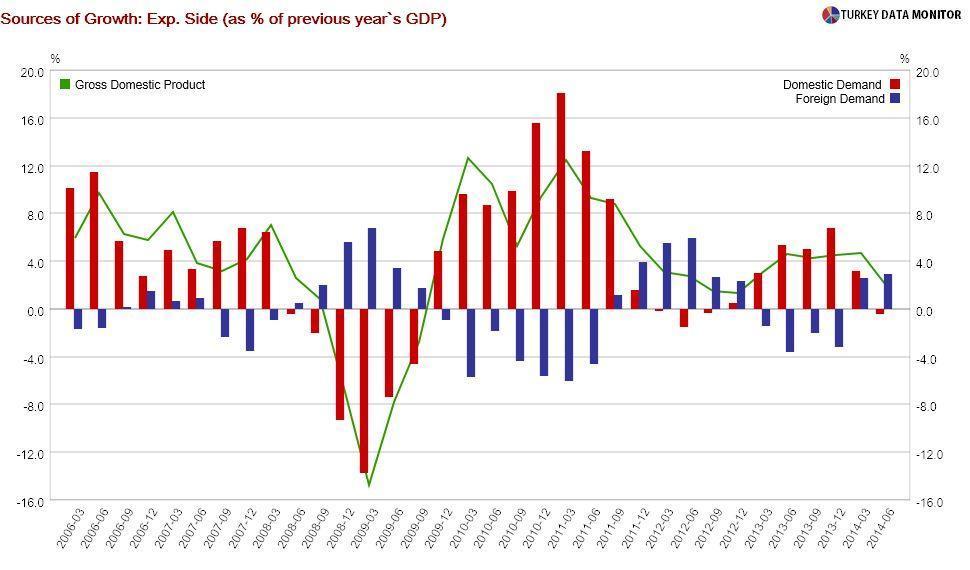

These figures confirm the Central Bank’s observation, as stated in the

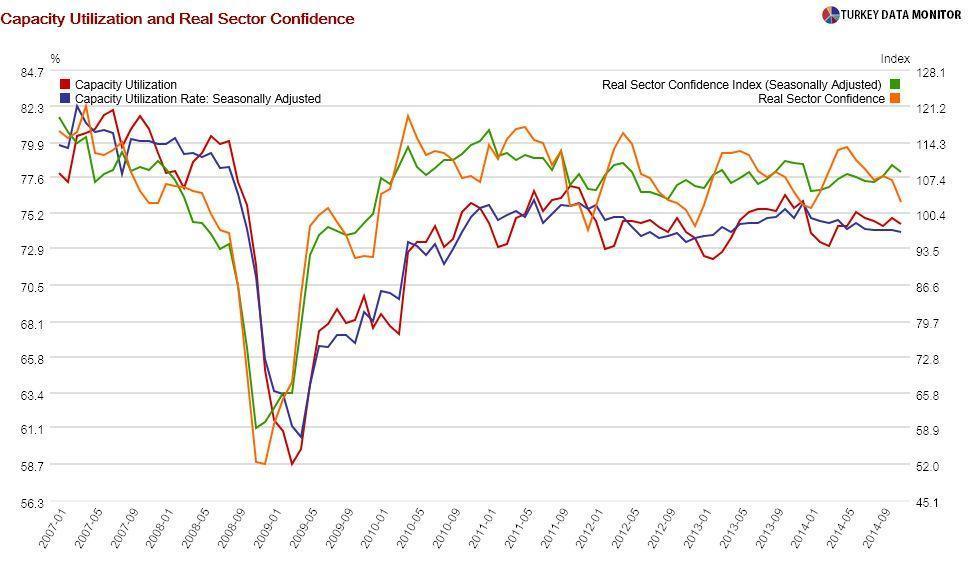

one-pager accompanying its latest rate decision, that “the contribution of domestic demand to growth is increasing.” But make no mistake; this is not a broad-based economic recovery. For example, the Bank’s latest

business tendency survey, which was released on Nov. 24, showed a fall in capacity utilization and real sector confidence index (RSCI) in November. While the latter is usually a good leading indicator of private investment, its fixed investment expenditures sub-index improved.

Similarly,

preliminary exports data from Turkish Exporters’ Assembly (TİM), which were also released on Dec. 1, contradicted the PMIs: Exports fell 6.4 percent annually in November. PMIs are not perfect leading indicators, and so I am more inclined to believe TİM’s figures, which track the official statistics very closely. Since virtually all of Turkey’s exports are to Europe or oil exporters, I would not be surprised by weak exports going forward. In fact, the RSCI sub-index for export orders for the next three months fell in November.

I am not sure if the recovery in consumption would be enough to jumpstart private investment. But I do know that the rate cuts expected from the Central Bank early next year will not be enough. While consumers are likely to respond to lower rates, business leaders take other factors, such as the strength of their export markets and domestic and geopolitical concerns, into consideration.

All in all, while there is an improvement in economic activity, the rebalancing from domestic to external demand is likely to slow down soon. Therefore, even though Turkey’s large current account deficit will continue to fall in the coming months thanks to lower oil prices, the country’s dependence on external financing, and therefore short-term capital flows, will continue.

Consumers will probably be the main engine of growth this quarter and next year. While this is great news for

President Recep Tayyip Erdoğan’s AKP, which faces general elections in June, it is not as good news for the sustainability of Turkish growth. Neither is it beneficial for consumers, who are, contrary to general opinion, a

lready quite indebted.

Recent Turkish data is hinting at an economic recovery driven by domestic demand, especially consumption, which is actually really bad news. I will explain myself, but let’s start with the facts:

Recent Turkish data is hinting at an economic recovery driven by domestic demand, especially consumption, which is actually really bad news. I will explain myself, but let’s start with the facts: