Which one is worse?

Is it the delay in the imminent policy decision by the Fed, America’s Central Bank? Or is it that in early 2016, Erdem Başçı, the governor of the Central Bank of Turkey, will have ended his term? Which one is worse for the Turkish economy? Let’s weigh the potential impact of each.

Is it the delay in the imminent policy decision by the Fed, America’s Central Bank? Or is it that in early 2016, Erdem Başçı, the governor of the Central Bank of Turkey, will have ended his term? Which one is worse for the Turkish economy? Let’s weigh the potential impact of each.The United States Federal Reserve is still on hold. This week’s meeting kept interest rates at zero. Why? Beats me. It’s as if the Fed is waiting for every economy in the world to reach bliss before taking rates back up. With the Fed’s inaction, I see a glimmer of hope in the eyes of some commentators in Turkey. Is there any reason for countries like Turkey to be hopeful with the delay in the Fed’s imminent policy decision? No. First of all, it is only a matter of time until the Fed does raise rates. No question about that. Second, I think that delaying the imminent decision will eventually require a steeper hike. I would have preferred them to have started early and gradually.

What then is that glimmer of hope in the eyes of some Turkish commentators? Any teacher will tell you that when you walk into a classroom on exam day and postpone the exam, there’ll be students who are annoyed and students who will be happy. “There’s still time,” they’ll think, and you’ll see that little twinkle in their eyes. They’ll fail of course, because if they aren’t the kind of students who study the first time around, they won’t take the time to make things right for the second date. Besides, the Turkish economy is too big of a thing to fix while waiting for an imminent Fed decision.

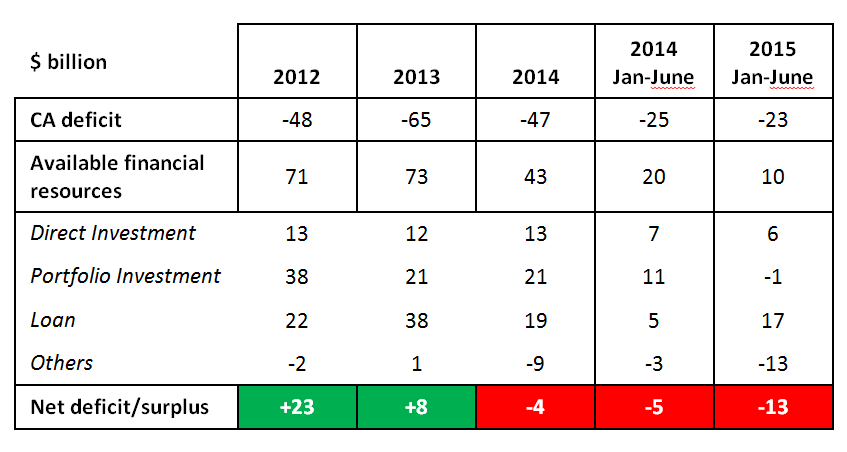

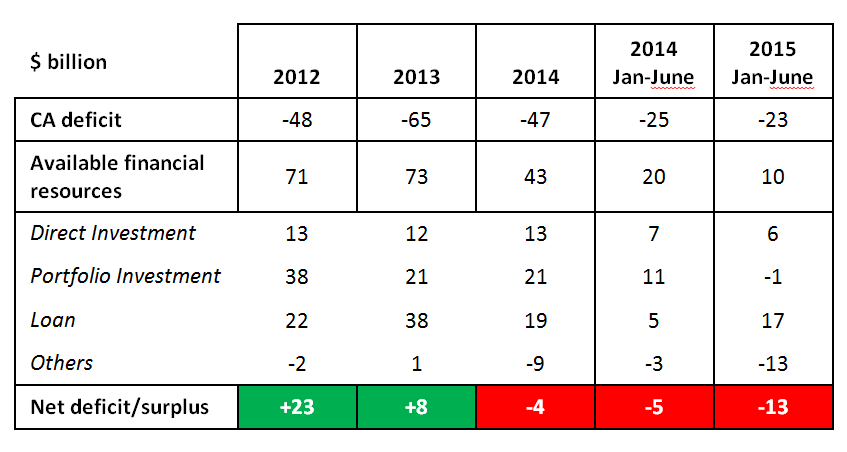

Though the Fed hasn’t inked it yet, market expectations mean that the rate increase is already with us. Just look at the fund inflows into the Turkish economy. In the good old days of easy money, just before the tapering, fund inflows into Turkey were 140-150 percent of the current account deficit. We always got more than we needed. Not anymore. The stream declined to 100 percent in 2013, and dipped below that in 2014 and 2015. The inflow of funds has declined relative to the size of the imbalance. So the effects are already with us. Just have a look at the table below to get an idea. Why has the Turkish Lira been depreciating lately?

When I compare the imminent Fed decision to the matter of Başçı, I find the latter as being more important for the Turkish economy. What will the end of the veteran central banker’s term mean? More policy uncertainty. Just think about the timing of it. A newly appointed head of the bank will have to deal with the Fed’s tapering at a time when the country is already suffering from a lack of faith. It will be especially difficult if the Fed’s delayed response will be steeper than initially expected. I hope I’m wrong.