Turkish gov’t seeking ways to manage private sector’s currency risks: Şimşek

Güneş Kömürcüler - ISTANBUL

AA photo

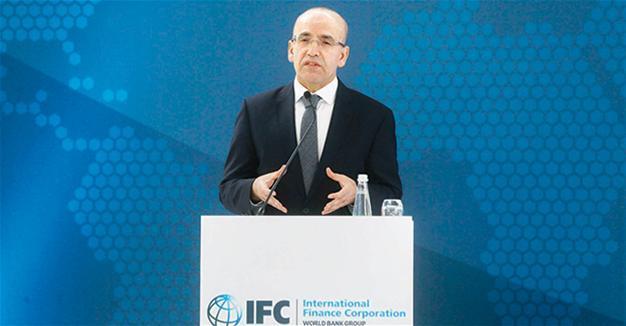

The government is set to launch a macro-prudential framework to overcome potential difficulties in the private sector in managing their foreign exchange risks, Deputy Prime Minister Mehmet Şimşek has said.“We have started to work on a plan how to manage the foreign exchange risks for businesses. We may bind risk-taking tendencies to some rules,” said Şimşek in a meeting organized by the World Bank’s International Finance Corporation (IFC) on Dec. 13.

He also added that some of the income from the individual pension system (BES) will be put into deposit banks in a bid to support lenders in 2017.

“The private sector is of great importance of us. We have recently created a 250-billion Turkish Lira financing volume for them under the guarantee of the Treasury. We are now working on the next step. How can businesses’ currency risks and their open positions be managed? What can we do to stimulate better hedging solutions? Perhaps we will need to start a macro-prudential framework for businesses in managing their currency risks, just as we did before for individual consumers. We may need to bind several risk-taking tendencies to specific rules,” Şimşek said.

The meeting in Istanbul marked the 30th anniversary of the opening of the IFC Turkey office.

Şimşek also added that foreign exchange borrowing by businesses without FX income might be curbed.

The private sector’s debts, amounting to around $200 billion, take the lion’s share in Turkey’s foreign exchange based debts. Concerns have recently risen about how companies will pay their debts, with the lira hitting record lows against the U.S. dollar and the euro this year.

“In the first place, we will focus on drawing a macro-prudential framework, mainly for the real sector, about how to meet foreign financing needs and manage foreign debts. Those companies that have an open position need to insure it by using financial derivative instruments. Such hedging methods are rarely used by our real sector but we will now work on a plan on how to help them in this area,” said Şimşek.

In the same speech, he vowed that Turkey would continue to be integrated with global actors, and noted that a revised Customs Union deal with Brussels would likely push up Turkey’s trade volume with the EU to $300 billion. He also said Ankara is working on striking free trade deals with a number of Gulf countries.

After the announcement of a 1.8 percent contraction in the Turkish economy in the third quarter of 2016, Şimşek said the government is “aware of the problems in the economy and is working to overcome these problems.”

“What is key for us is to realize the required structural reforms one by one … At this point, we must support our private sector more,” he said, adding that the IFC is one of most significant partners of Turkey.

Around $650 million in financing since July 1

Speaking at the same meeting, IFC President and CEO Philippe Le Houérou underlined the challenges both in the global economy and in the Turkish economy.

“We continue to invest in Turkey in all conditions. Why? Since our first investment decades ago, Turkey has advanced very much, from a low-income to a high-income country,” Houérou said, noting that Turkey was the second largest party of the IFC’s investment program after India and Istanbul hosted its second largest office after its Washington office.

During the fiscal year 2016, which ended on June 30, the IFC committed a total of $1.8 billion in equity, long-term loans, interest rate swaps and trade finance across 18 projects, according to IFC data.

The organization has offered $502 million long-term loans to a total of seven projects in Turkey and $145 million in short-term trade financing since July 1, when the 2017 fiscal year started, according to IFC data.