Turkish economy: Shakespeare’s or Shakespearian tragedy?

In my latest column on Nov. 15, I noted the October budget and August labor force statistics, which would be released that day, would hint if we are to see election economics in the coming months. So you have every reason to ask me, “what news?”, as Hamlet asks Rosencrantz in Shakespeare’s tragedy.

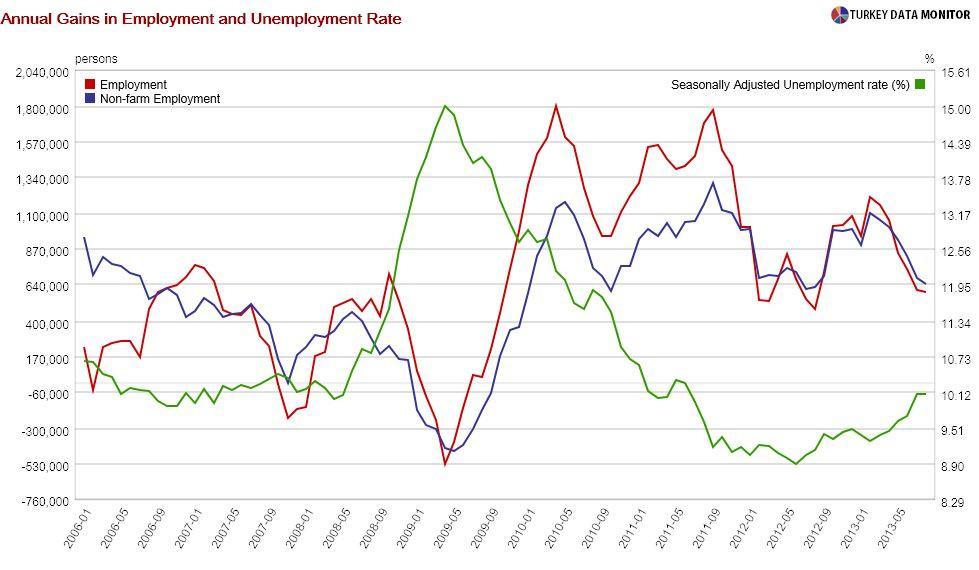

In my latest column on Nov. 15, I noted the October budget and August labor force statistics, which would be released that day, would hint if we are to see election economics in the coming months. So you have every reason to ask me, “what news?”, as Hamlet asks Rosencrantz in Shakespeare’s tragedy.I consider Bahçeşehir University think tank Betam to be Turkey’s labor market experts. They decreed unemployment to be on a horizontal course in their note about the statistics. They were merely stating the facts: the seasonally adjusted non-farm unemployment rate stayed put at 12.5 percent. However, in the data, I saw several signs of a rising unemployment rate.

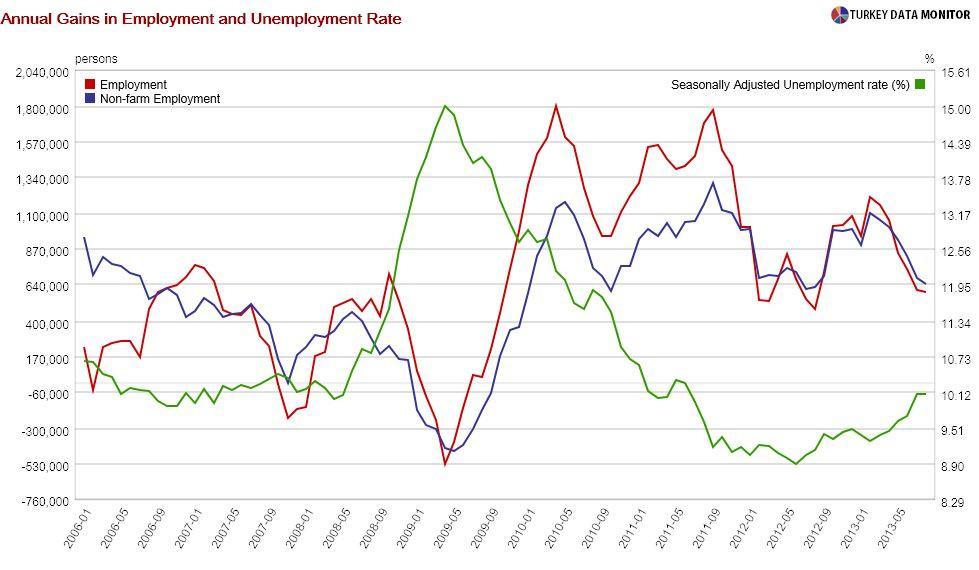

For one thing, annual employment gains continue to decrease. The economy had 593K additional jobs in August compared to the same month of the previous year, down from over a million early in the year. There is a similar trend in non-farm employment, but you could argue that employment gains could be stabilizing around 600K.

Incidentally, a back of the envelope calculation showed the annual rise in employment had to be around this figure to keep the seasonally adjusted unemployment rate stable. Therefore, further falls in job gains would change the unemployment outlook from a horizontal course to downward spiral.

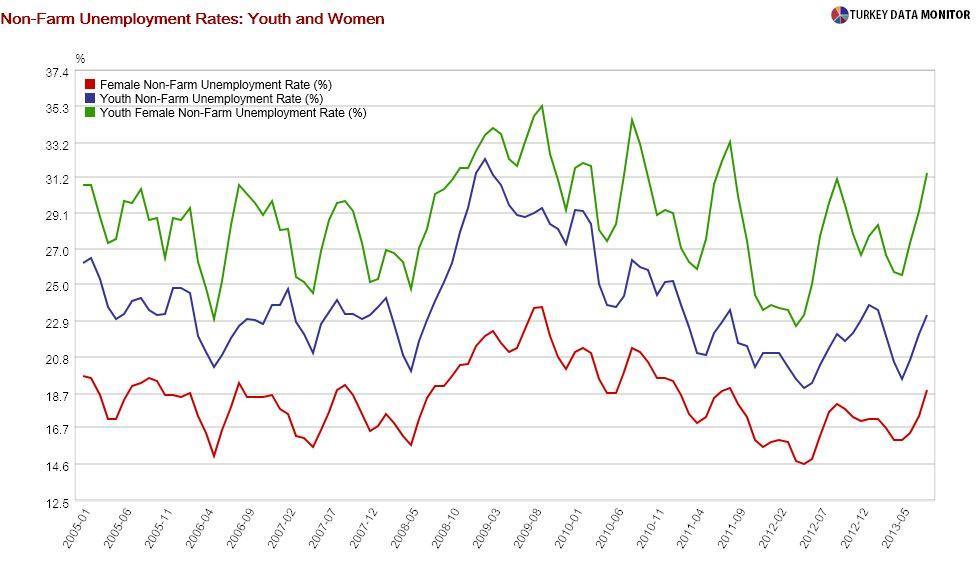

To add insult to injury, the sharpest increases in unemployment are in the relatively disadvantaged portions of the labor market, such as the young and women, especially young women. Nearly one in three women between the ages of 15 and 24 in non-agriculture are now looking for jobs but can’t find one.

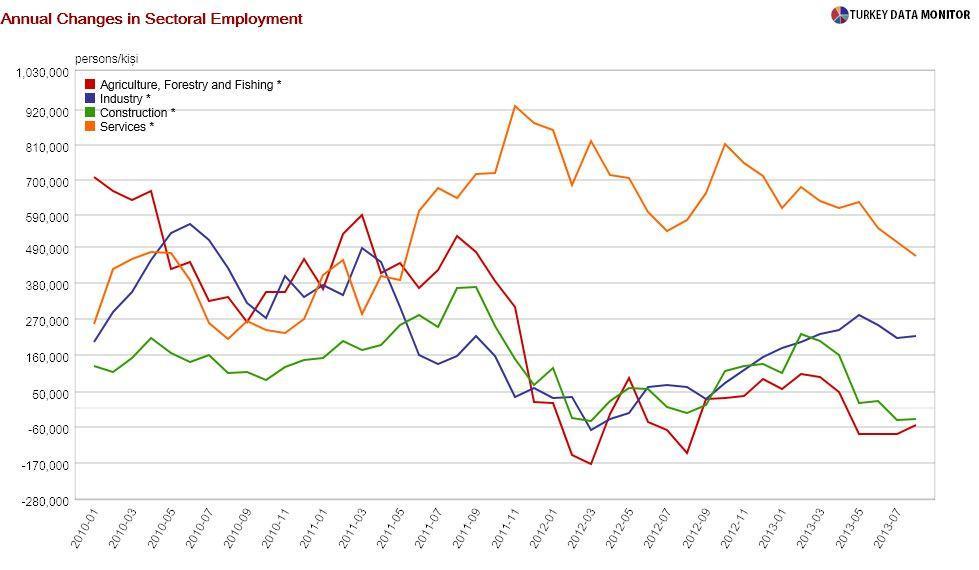

There isn’t much reason to cheer about sectoral data either. Even employment in the construction sector, the pride and joy of the government, painted a mixed picture at best in August. Employment in the sector fell by 34K annually, but after weeding out seasonality in the data, Betam found a monthly 48K rise.

Any government official that sees this picture four months before elections will not just sit back and relax. The October budget figures are hinting that they are not. While the headline number looks robust, with the government set to easily reach the end-year targets and close the year with a deficit of 1.2 percent of GDP, it is the composition of the budget that is worrying me.

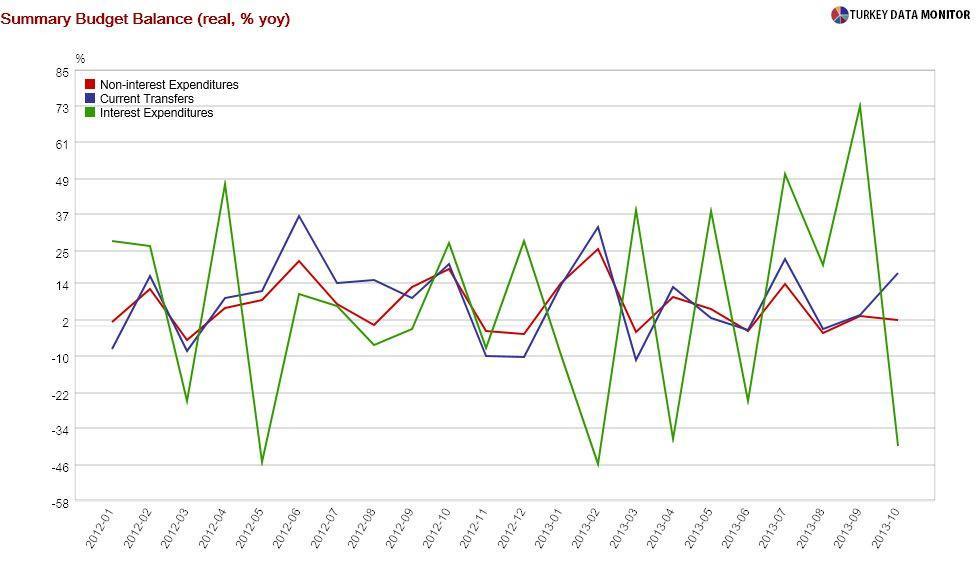

For one thing, a significant chunk of the seeming improvement in the annual deficit owes to interest expenditures, which plunged 39.9 percent yearly in real terms. In fact, non-interest expenditures rose 2 percent, driven by the 17.4 percent jump in current transfers, both in real terms.

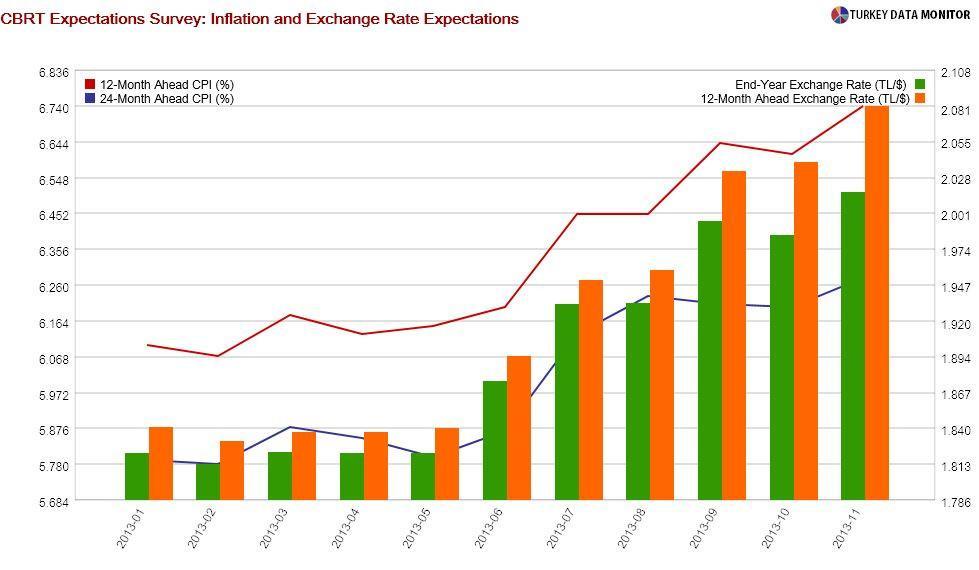

As you can see, based on the data of Nov. 15, I would have to answer your question with “None, my lord, but election economics is ahoy.” What if I also told you that data from Nov. 15 showed that inflation and exchange rate expectations were worsening?

You’d then ask me as Hamlet did to Rosencrantz: “Then is doomsday near?” Yes, it is my lord. It is unfortunately very near. The Turkish economy is looking more and more like a Shakespearian tragedy.