Turkish Central Bank sharply hikes key rate, helps lira gain value

ANKARA

Turkey’s central bank raised its benchmark rate by 625 basis points on Sept. 13 in a move that boosted the Turkish Lira and may ease investor concerns about monetary policy.

The Central Bank has increased the lending rate to 24 percent, meaning it has now increased interest rates by 11.25 percentage points since late April.

The bank said there was still an upside risk to the inflation outlook from what it called a deterioration in pricing behavior, despite weaker domestic demand conditions.

“Accordingly, the Committee has decided to implement a strong monetary tightening to support price stability,” it said in a statement.

“Inflation expectations, pricing behavior, lagged impact of recent monetary policy decisions, contribution of fiscal policy to rebalancing process, and other factors affecting inflation will be closely monitored and, if needed, further monetary tightening will be delivered,” it added.

A hike from the previous level of 17.75 percent was widely expected, but there were varied expectations about the new interest rate.

Big moves

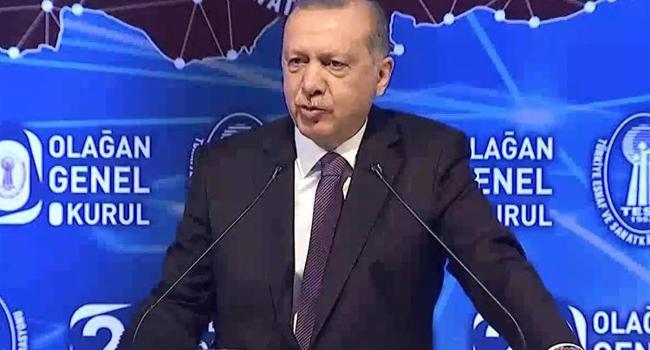

The decision came despite Erdoğan repeating his opposition to high interest rates earlier in the day, saying “high inflation was a result of wrong steps by the Central Bank.”

In a speech in Ankara, Erdoğan underlined his “sensitivity about the interest rate staying the same” while stressing the bank “is independent and makes its own decisions.”

The lira steeply gained ground against the United States dollar and the euro after the rate decision, hitting the lowest level in two weeks with 6.01 and 7.01, respectively. It later eased to 6.16 against the greenback and 7.22 against the euro.

The lira has collapsed nearly 40 percent this year amid various concerns, triggered by a rift between the U.S. and Turkey over a U.S. Christian pastor being tried in Turkey.

Official figures on Sept. 3 showed Turkey’s annual inflation was 17.9 percent in August, up from July’s figure of 15.85 percent.

Hours after the release of the inflation data on Sept. 3, the Central Bank had announced it would take the necessary actions to support price stability.

“Accordingly, in line with the previous communication, monetary stance will be adjusted at the September Monetary Policy Committee Meeting in view of the latest developments,” it then said.

Funding on weekly basis

Meanwhile, the Central Bank also said its funding, which is currently provided through overnight lending, will be provided via one-week repo auctions starting from Sept. 14.

“A one-week transition period has been envisaged for providing all of the funding via one-week auctions,” it said on Sept. 13, adding that technical details would be announced.

Turkish President Erdoğan vows to ‘take new steps on foreign currencies’