Surely you’re joking, my fine man

That was my reaction when I read Economy Minister Zafer Çağlayan’s written statement after the second-quarter growth figures were released last Monday.

The minister,

affectionately known as the Admiral after he declared that his ministry was the government’s Admiral Ministry, advised the Central Bank to

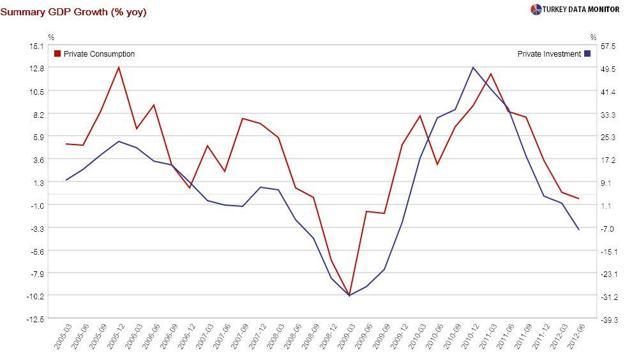

take its foot off the brake. He has my full sympathy. At 2.9 percent, yearly growth has

turned out to be lower than expectations of 3.3 percent.

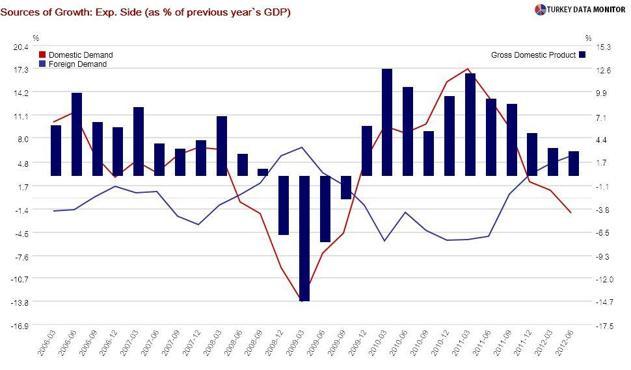

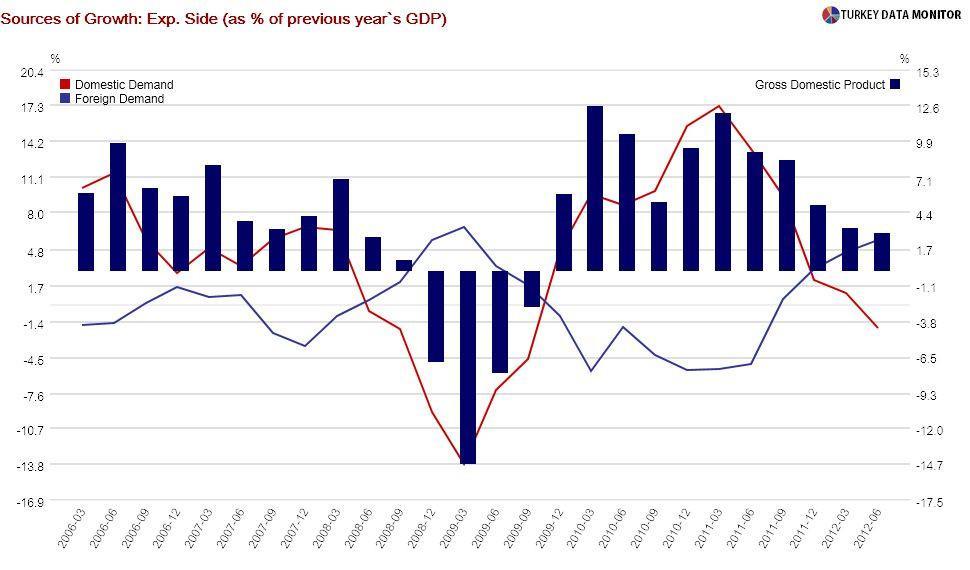

More importantly, the rebalancing from domestic to external demand seems to have gone a bit too far: The latter’s contribution to growth was 5.7 percent, while the former shaved 2 percent off growth.

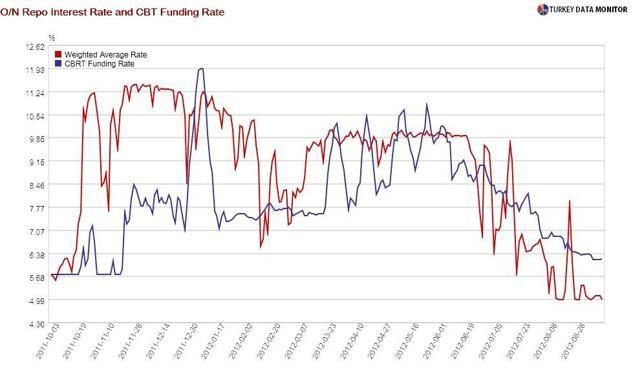

But the Central Bank has not only not touched the brake pedal for a while, it has been stepping on the gas since June by lowering its effective funding rate, which is the average rate at which it lends to commercial banks. That rate, which was 10.8 percent at the end of May, is now 6.2 percent. The overnight repo, which you can think of as a marginal rate, is 5 percent.

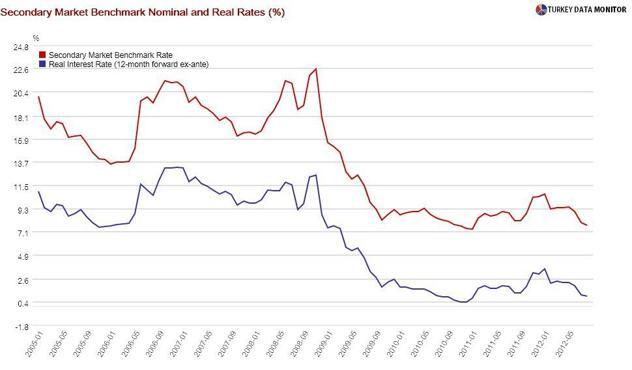

You may argue that these are nominal rates, but real Treasury bond rates are below 1 percent. Policy is in fact tight only by definition: The Central Bank declared some time ago that it would be called “tight” as long as the effective funding cost was above the one-week repo rate of 5.75 percent, which is the

rate formerly known as the policy rate, just like the artist formerly known as Prince. So maybe the column’s title should be directed at the Central Bank rather than at Çağlayan.

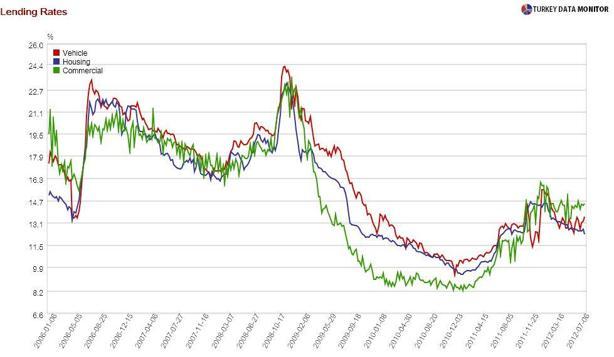

Funnily enough, these low rates have not boosted activity. Since they can oscillate in a wide corridor between the Central Bank’s overnight borrowing and lending rates of 5 and 11.5 percent, there is quite a bit of uncertainty in rates. The cost of a loan from a commercial bank has not gone down by a whole lot as a result. This is why the Central Bank is expected to narrow this corridor by cutting its lending rate by 0.5-1 percentage points at the Monetary Policy Committee meeting tomorrow.

In fact, the Central Bank is aiming for a fine-tuned intervention, according to the Bank’s chief economist Hakan Kara. At the Bank’s

latest meeting with market economists, he explained that since consumer lending is financed by wholesale funding and swaps, whereas corporate lending with domestic funds, a cut in the ceiling would lower commercial more than consumer loan rates.

This looks fine on paper, especially since investment shrank more than consumption in the second quarter, and the Bank would not want demand-side inflation pressures. But I have yet to figure out how companies would keep on investing, producing and building inventories without anyone buying their goods, domestic or externally.

In fact, although Çağlayan declared, after the

July current account release on Tuesday, that strong export performance was driving the improvement in the current account, the data do not support his claims. Both export and import growth have decreased; it is just that the slowdown in imports has been more pronounced.

I could give him the benefit of the doubt on the real economy, but the Admiral is surely joking when it comes to trade, his Admiralty’s main responsibility.

That was my reaction when I read Economy Minister Zafer Çağlayan’s written statement after the second-quarter growth figures were released last Monday.

That was my reaction when I read Economy Minister Zafer Çağlayan’s written statement after the second-quarter growth figures were released last Monday.