Rashomon, the Eurozone crisis and Turkey

Andrew Lo, professor of finance at MIT, likened the different financial crisis narratives to Akira Kurosawa’s Rashomon when he recently reviewed 21 books about the financial crisis.

In

the movie, a crime is recounted differently by each protagonist. Lo argued that

there are “several mutually inconclusive narratives” of the 2008-2009 crisis. Similarly,

there are two distinct tales of the Eurozone crisis.

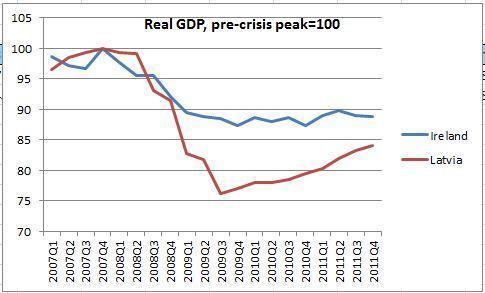

According to the German version of the story, fiscal profligacy is the culprit, and therefore austerity the cure. Moreover, fiscal restraint will restore markets’ confidence. Just look at how well Latvia and Ireland, two countries that swallowed their painful pills, are doing!

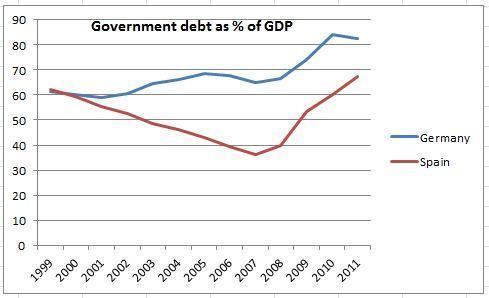

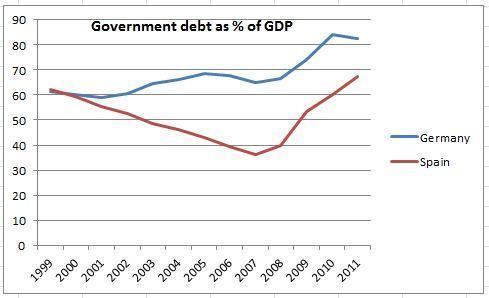

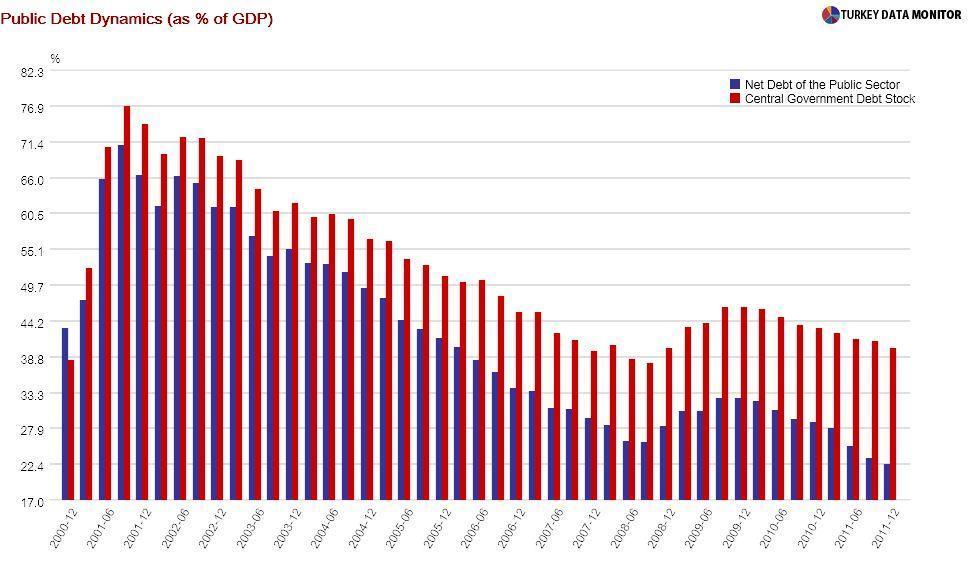

Nobel laureate Paul Krugman, professor of economics at Princeton and columnist for the New York Times, disputes this narrative. He first notes that Spain’s government debt to GDP ratio was actually declining from 1999 until the crisis, whereas Germany’s was creeping up.

As for the two poster children, Ireland and Latvia’s GDPs are still significantly below pre-crisis levels. To add insult to injury, Ireland's credit default swaps, which provide insurance against the country's not paying its debt, are more than twice Turkey’s and imply an annual probability of default of nearly 8 percent.

This narrative is not without holes: Spain’s problem was not fiscal but private sector profligacy, led by housing. And the German argument holds much better for Greece. But Krugman is right that markets are definitely not rewarding austerity. Besides, I have yet to meet this famous “confidence fairy”.

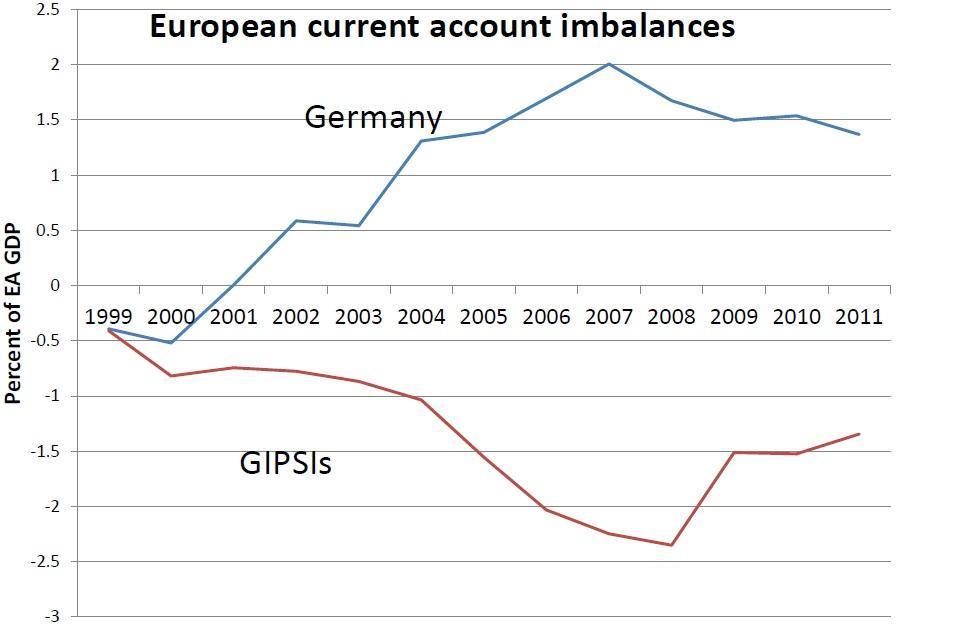

In any case, I would agree with Krugman that Europe’s main problem is balance of payments. Germany’s current account surpluses were matched by the deficits of Greece, Italy, Portugal, Spain and Ireland, collectively known as the GIPSIs.

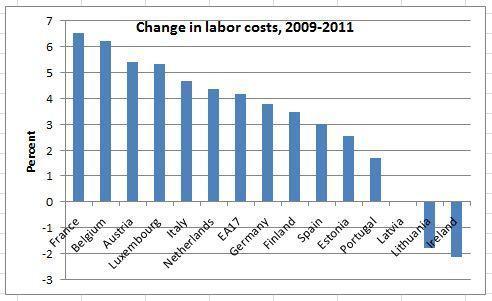

Concurrently, there were huge capital flows to the GIPSIs, which were the driving force behind the public or private spending binges. This was fine as long as the music kept playing, but once it did stop, these countries could not use the exchange rate for adjustment and had to resort to internal devaluation, i.e. painful wage cuts.

How does Turkey fit in all this? For one thing, Turkish policymakers are firmly sticking with the German narrative. For example, economy tsar Ali Babacan’s speech at the Istanbul Finance Center conference last week could have easily come from Deutsche Bundesbank President Jens Weidmann.

But maybe this adherence reflects realpolitik more than anything else. With a debt to GDP ratio of 40 percent at the end of 2011, Turkey looks like the real poster child for austerity, even though the IMF has recently warned that budget balances are not as strong as they look.

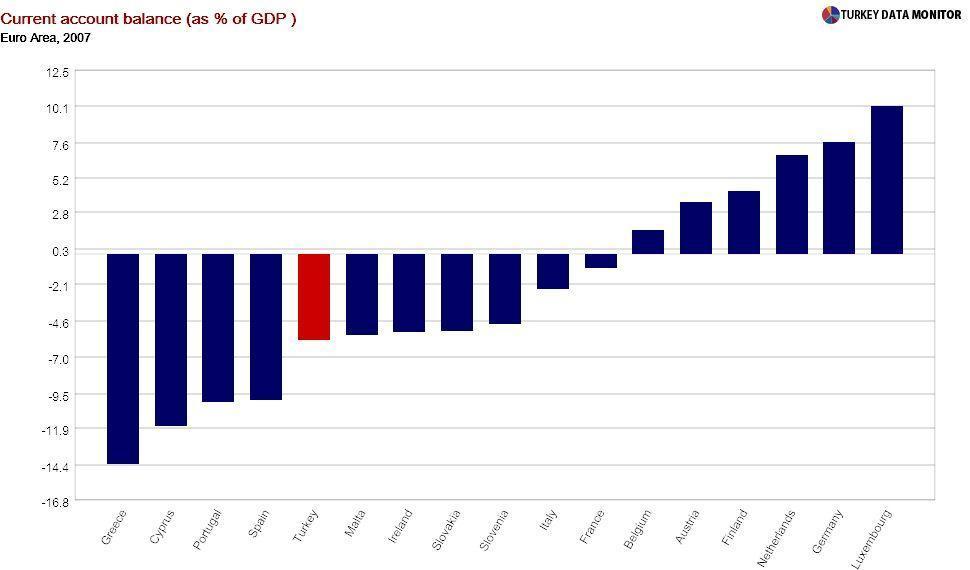

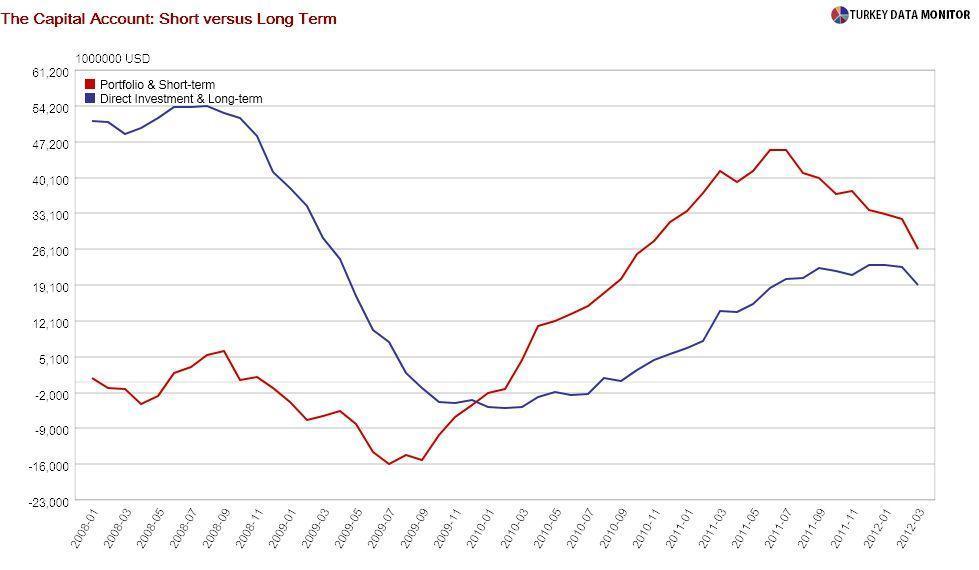

More importantly, once you subscribe to the Krugman narrative, you may suddenly notice that Turkey’s current account deficit of 10 percent of GDP is comparable to the GIPSIs’ levels before the crisis. Moreover, that deficit is still financed by short-term capital flows, as Friday’s March figures confirmed.

Unlike the GIPSIs, Turkey can use the exchange rate and monetary policy as adjustment mechanisms, but you just wouldn’t want to alarm markets.

Graphs 1, 2, 5 and 6 as well as the confidence fairy are from a presentation Paul Krugman gave in Brussels on Thursday.