Petrol Ofisi indictment and the facts

HOW CAN A NON-EXISTENT TAX BE EVADED? The indictment issued by Adem Meral, an Istanbul prosecutor who seeks up to 24.5 years in prison for Aydın Doğan, the Honorary Chairman of Turkey’s leading Doğan Holding, is full of mistakes and contradictions. For instance, it is impossible to collect or evade a tax for an import transaction that is not taxed in legislation. The prosecutor’s ‘forge of document’ claim for a non-existing tax is illogical, while claims sourced to an unnamed informant are not supported by any document.

HOW CAN A NON-EXISTENT TAX BE EVADED? The indictment issued by Adem Meral, an Istanbul prosecutor who seeks up to 24.5 years in prison for Aydın Doğan, the Honorary Chairman of Turkey’s leading Doğan Holding, is full of mistakes and contradictions. For instance, it is impossible to collect or evade a tax for an import transaction that is not taxed in legislation. The prosecutor’s ‘forge of document’ claim for a non-existing tax is illogical, while claims sourced to an unnamed informant are not supported by any document. 1. The indictment issued by the İstanbul Chief Public Prosecutor’s Office, claiming that Petrol Ofisi was involved in organised crime between 2001 and 2007 has become a contentious issue and led to criticism. What other key observations can be pointed out when the indictment is examined in detail?

What we have before us is a text filled with errors and contradictions, with circumstances and findings that defy logic and are contrary to law; and what’s more, it has significant problems in terms of the manner in which the legislation was interpreted, and in terms of the procedural aspects of the indictment. Furthermore, the fact that the extremely grave and dire accusations raised in the text are not being supported with documents and evidence emerges as a significant shortcoming of the indictment. We can say that two main accusations are raised in the indictment: 1) Allegations of customs duty evasion, 2) The accusation that the VAT payable in customs was paid incompletely... The Public Prosecutor claims that the partners of Petrol Ofisi, all the board members who have served in the company between 2001 and 2007, as well as some of the professional executives of the company, acted in an “organized crime network” to that end. An interesting aspect is the allegation that an “organization” was founded by Aydın Doğan, who was then the Chairman of Doğan Holding, and Ersin Özince, who was the General Manager of İş Bankası at the time. In other words, this indictment describes Aydın Doğan and Ersin Özince as “the leaders of the organised crime network”, and the board members of Petrol Ofisi as well as some executives of the company as “the members of the crime organization.” Moreover, the members of this “organization” include the senior executives of OMV, which became a partner of Petrol Ofisi after 2006, and which is an Austrian state company.

2. Let us examine the allegations one by one. First, let us look into the allegation of customs duty evasion. What is this allegation?

This allegation is based on the written statement of an informant, whose identity is kept hidden. The only basis of the accusation is this statement by the informant. This informant is an individual who is capable of raising strange theses in his statement such as, “All fuel oil companies in Turkey evading customs duties led to state budget calculations not holding up, which caused difficulty for the Turkish finance administration.” Such theses give an idea about the credibility of the allegations of the informant. The charge regarding the customs duty evasion is one of the weakest points in the indictment. Let us try to explain the reason in very plain words. As per the laws in Turkey, importing fuel oil products is exempt from customs duty, regardless of their origin. That is, customs duty is zero when importing fuel oil products. The customs duty that any fuel oil distribution company will pay when importing fuel oil from any country, whether it is the EU countries, Russia, or Ukraine, or Israel, or Algeria, is zero. That is the plain and simple truth. Unfortunately, the Public Prosecutor’s Office has entirely ignored this concrete fact.

3. What is the exception to zero customs duty when importing fuel oil?

The only exception to this would be the decisions governing the importation regime of the imported fuel oil, and non-compliance with the criteria set forth by the Turkish Standards Institute. Compliance with the standards is checked with inspections conducted at customs laboratories. All fuel oil imported by Petrol Ofisi between 2001 and 2007 has been found to have complied with the standards following such inspections. And indeed, no allegations are made in the indictment against Petrol Ofisi in terms of compliance with the standards.

HOW A NON-EXISTENT

TAX IS EVADED

4. So, in that case, how has tax been evaded?

That very question constitutes the biggest mystery in the indictment. Because, it is – logically – not possible to collect taxes on an import which is not subject to taxation as per the legislation. Naturally, one cannot talk about evading a tax that does not exist. The public prosecutor turning such an allegation into an indictment, despite this explicit provision in the law, and using it as a basis to incriminate deserves and requires an explanation in every aspect. Moreover, it is further claimed in the indictment that “document forgery” was committed for this non-existent tax. Why would one forge a document to evade a non-existent law? That also emerges as yet another one of the many mysterious issues in the indictment.

5. The second allegation is based on the accusation that Petrol Ofisi did not pay the full VAT for the imported fuel oil products – by claiming a lower price. Has the VAT been paid incompletely?

This is an accusation which cannot be applicable in any manner whatsoever, neither in theory, nor in practice. We should briefly describe how the VAT system operates in order to explain this. By definition, VAT is a tax paid by the end user at the final stage. This is how VAT accrual operates: VAT accrues at every stage until the commodity is sold to the end user, that is, every time the commodity changes hands. However the VAT payable every time the commodity changes hands and is purchased is deducted from the VAT charged when the commodity is sold, in order to prevent the payment of repetitive taxes. This is an explicit provision that is stipulated in the VAT Law of 1984.

When we examine it using the Petrol Ofisi example, we see that VAT has accrued in two stages during the course of selling the commodity. In the first stage, when the imported fuel oil arrives at the customs, Petrol Ofisi VAT payment liability is 18 percent of the purchase price. In the second stage, when Petrol Ofisi adds its profit on this commodity and sells it to its dealers, 18 percent VAT calculated based on the sales price is added to the invoice total, and thus, the price of the commodity including the VAT is collected. As it can be seen there is A) the VAT paid by Petrol Ofisi first at the customs, and B) the VAT collected from its dealers. As per the VAT Law, the liability of Petrol Ofisi is to deduct the VAT collected from the dealers from the VAT paid at the customs, and pay to the state the VAT difference between the two. Thus, Petrol Ofisi pays to the state the VAT corresponding to the sum of what has been at the customs and what has been charged from the dealers at its headquarters.

Now let us explain this with one example. Let us assume that Petrol Ofisi has imported a commodity from overseas with an invoice value of 100 Turkish Liras. Petrol Ofisi pays the state VAT of 18 liras, corresponding to 18 percent of this amount. When Petrol Ofisi sells this fuel oil to its dealer for 110 liras – with an assumption that 10 percent profit has been added – the sales price in the invoice is specified as 110 liras, and the VAT is added as

19.80 liras, and collects 129.80 liras from the dealer. As can be seen, the VAT that is collected is 19.80 liras. However, the VAT amount that Petrol Ofisi paid at the customs when importing the fuel oil was 18 liras. There is a difference of 1.80 liras. Petrol Ofisi is required to pay to the state the difference between the two. So Petrol Ofisi pays to the state a total of 19.80 liras VAT. This means that the entire VAT collected from the dealer is paid to the state.

6. So then, what is the Prosecutor’s Office accusing Petrol Ofisi of?

The main accusation of the public prosecutor in this respect is the allegation that Petrol Ofisi has bought fuel oil with low prices from POINT (Petrol Ofisi International Trading), which trades fuel oil products causing the payment of a low VAT at the customs, and thus transferring unjust earnings to the members of the “criminal organization with the purpose of generating monetary profit.” We must first emphasize that such an allegation is entirely baseless in the operation of the VAT system as explained above. In line with the legislation in Turkey, the VAT that is payable to the state is the tax charged from the end user. Therefore, even if the VAT has been paid incompletely due to an erroneous customs procedure, this does not lead to an incomplete payment of the final tax payable to the state. Therefore, because the VAT that Petrol Ofisi had paid at the customs being paid incompletely or in excess will not change the final tax amount, one cannot talk about a tax loss. Indeed circular 3175 of the Customs General Directorate does confirm this. To summarise, it is not possible, neither legally nor in practice, for the company, or the executives thereof, to acquire any gains from an incomplete payment of the VAT at the customs. Furthermore, it is useful to remind of another fact. Petrol Ofisi, a public company, has been audited several times, including all the imports transactions, by many public audit authorities between 2001 and 2007, and no negative findings or criticisms were raised following such audits about the transactions in question, and no fines were imposed.

7. What is the amount of this monetary gain claimed to have been obtained by this “organized crime organization”?

The public prosecutor claims that an “incomplete VAT base was declared” by $6,328,000 by this “crime organization” between 2001 and 2007, in (page 64 of) the indictment. In the next page (65), it is claimed that a “tax loss” of $6,328,000 was caused. We see, through these conflicting statements, that the public prosecutor is making a serious mistake. Because a tax base and a tax loss are two different values. The tax base is the total value, based on which the tax will be calculated. For instance, if we are talking about the VAT, 18 percent of the tax base is calculated as the tax. And tax loss is a partial or entire non-payment of the tax. The public prosecutor is first claiming the same quantity in dollars is “the tax base declared incompletely,” and then claims that that sum “is the tax loss.” If that sum is the tax base, then in that case, the VAT of $6,328,000 would be $1,139,000 (based on an 18 percent calculation). In that case, the gain that is claimed to be obtained by 47 people, through an organization, with criminal activities that last for 7 years is $1,139,000. Most probably, the public prosecutor must have found that quantity insufficient for an accusation of forming a criminal organisation, as he presents the amount of $6 million not as the tax base, but as the “tax loss,” in a different section in the indictment. We must, of course, not forget that Petrol Ofisi imported fuel oil worth $6.3 billion between 2001 and 2007, and paid VAT in the sum of $1,134,000 to the state. While we are discussing this matter, it is useful to keep in consideration this dimension as well, from a monetary volume standpoint of the issue. The $6.3 million tax base that constitutes the subject of the allegations corresponds to approximately 1 per mil of the total imports.

PAYING TAXES IN TURKEY

RATHER THAN BRITAIN

8. One of the most contentious aspects of the indictment is the fact that Petrol Ofisi built an overseas company, POINT, and made its fuel oil purchases through this company. It is said that LYSA, a company with a capital of two dollars, registered in the Bahamas, was acquired, and then its name was changed to POINT. What can you say about these accusations?

In order to be able to understand this aspect of the matter, we must briefly explain the structure and the operation of fuel oil companies and the international oil market. All fuel oil companies operate their oil buying and selling transactions through the offices and companies they have founded at a few main centers such as London or Singapore. The major fuel oil companies in Turkey also have representative offices, and companies they have built in these centers overseas. The most important oil exchange and trading centre in Europe is in London. Petrol Ofisi has decided to carry out its activities through London in order to be able to import from international markets with more affordable prices, and therefore founded the companies POUK (Petrol Ofisi UK) in London and POINT (LYSA, with its former name) in the Bahamas. The headquarters for POINT was decided to be located in the Bahamas, because if the headquarters of the company had been in London, the tax to accrue from the gains to be obtained by POINT due to such buying and selling transactions would have to be paid in the United Kingdom. Whereas, as the profit earned by POINT is combined (consolidated) with the balance sheet of Petrol Ofisi, the tax for such earnings has been paid in Turkey, because there is no taxation in the Bahamas. As can be seen, the reason for opening a company in the Bahamas is not to evade tax in Turkey, but on the contrary to pay taxes in Turkey instead of in the United Kingdom.

HOW A TAX CHAMPION

IS ACCUSED…

9. How factual is the allegation against Aydın Doğan of “founding an organization with the intent of committing crimes”?

This is where we come across one of the gravest accusations in the indictment. The public prosecutor claims that this “criminal organization” has two founders. These individuals are Aydın Doğan, who was then the chairman of Doğan Holding, and Ersin Özince, who was the general manager of İş Bankası at the time.

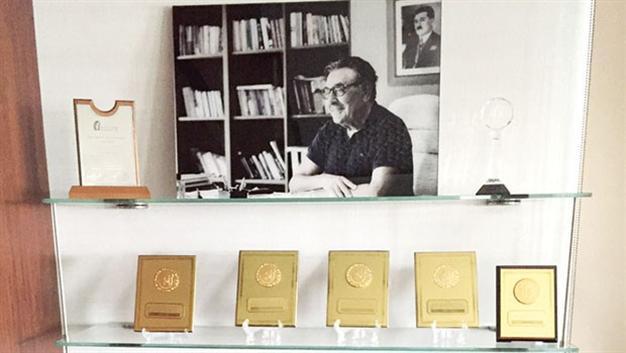

Firstly, the owners of one of the biggest holding companies in the company, and the then most senior executive of the most reputable and biggest bank in the country getting together and agreeing to form “a criminal organisation for monetary gains,” with the intent of tax evasion, is beyond reason and logic. Aydın Doğan, who is accused of founding an organisation to evade taxes, is among the highest income tax payers in Turkey in the 1990s and 2000s. The public prosecutor claims that the criminal organization built by Aydın Doğan was operative between 2001 and 2007. Now let us take a look at Aydın Doğan’s ranking among the highest income tax payers in Turkey between those dates, as announced by the Ministry of Finance: 2001: highest in Turkey, 2002: second highest in Turkey, 2003: second highest in Turkey, 2004: second highest in Turkey, 2005: highest in Turkey, 2006: second highest in Turkey, and 2007: highest in Turkey. As a result, to accuse a reputable businessman who paid the highest taxes in Turkey three times during the that time period, and who was honored by the state with a plaque, of building an organization with the intent of tax evasion is unconscionable. It would be best to leave this matter to the verdict of public opinion. The statement made by Doğan Holding on March 23 on this matter is as follows: “Such an allegation for Aydın Doğan is truly ugly, inappropriate and an outright shameful accusation. There are no responses for such an allegation. Those who come up with such an ugly, inappropriate and shameful accusation could only be left to God’s mercy.” We would like to attract your attention to another important detail: Neither Aydın Doğan nor Ersin Özince served in the management of Petrol Ofisi. Neither of them were in the Petrol Ofisi board of directors. Accusing non-board members of being board members, and thus attributing responsibility, constitutes one of the weakest links in the indictment from a legal standpoint. Furthermore, everyone who was a member of the Petrol Ofisi Board of Directors is accused in the indictment of being a member of the organized “crime organization.” This becoming an established pattern of accusation will indicate an extraordinarily dangerous trend in Turkey. Unfortunately this would pave the path for seeing the board of directors of companies as potential criminal organizations in their entirety.

10. What is the role of OMV in this “criminal organization”?

It would be best for the company itself to respond to such accusations. An Austrian state company, OMV is among the largest companies in energy business in Europe. 51 percent of Petrol Ofisi was acquired in the form of a 50-50 share partnership between Doğan Holding and İş Bankası in 2000. İş Bankası then left the sector in 2005, after selling its shares in this partnership to Doğan Holding. Doğan Holding sold a portion of these shares to OMV in the following year. Consequently, OMV became a part of Petrol Ofisi management, and was represented with an equal number of board members as Doğan Holding. The public prosecutor automatically assumes these 5 foreign OMV representatives who had started serving as board members at that time as members of this “criminal organization.” Of the OMV representatives who are listed as defendants in the indictment, four members are Austrian nationals and the remaining member is a U.K. subject. From such a perspective, it looks like a “handover” of sorts in the criminal organisation membership was executed - in the public prosecutor’s opinion - with the admission of OMV representatives in management after İş Bankası representatives left Petrol Ofisi.

NOTE: Doğan Holding separated from OMV by selling all of its shares in Petrol Ofisi to OMV in 2010. Currently, OMV possesses the majority shares of Petrol Ofisi.