Inflation the most important issue facing Turkey’s economy in 2018: Journalist Cüneyt Toros

Barçın Yinanç - barcin.yinanc@hdn.com.tr

High inflation is the most important issue facing the Turkish economy in 2018, journalist Cüneyt Toros has told the Hürriyet Daily News.

“We are currently at a turning point. Until recently Turkey grew through the private sector. But now the government has stepped in with various incentives it has been providing. There is a cost to this and that is inflation” said Toros, the editorial director of economy magazine Fortune Türkiye.

Tell us about your forecast of the Turkish economy in 2018.

Turkey caught a good growth figure in 2017. But we need to analyze how this growth was secured, as that will signal how the country will grow in 2018.

Turkey faced serious challenges in 2016, starting with the July 15 military coup attempt, and the economy nearly came to a standstill. The state therefore intervened and started providing serious incentives to the economy, starting with the credit guarantee fund [KGF]. Domestic consumption was stimulated as the state gave incentives to keep the economy going. But if we recall the early periods of the Justice and Development Party [AKP], the growth strategy was based essentially on the private sector. The main motto was that the state will retreat from the economy, bringing under control the budget deficit and the foreign exchange deficit and maintaining fiscal and monetary discipline. That’s how Turkey grew in the 2000s.

Currently we are at breaking point. I am not saying it is right or wrong, but the state is now heavily in the equation. It was in fact obliged to enter the equation, as the private sector had became highly indebted during the period of high growth. But the result of the state’s intervention is inflation and a growing budget deficit. Also let’s not forget that we had a referendum on the executive presidential system in April 2017 and everywhere in the world during elections there is a rise in state spending.

Inflation is something new generations do not remember, but older generations do. You cannot have stability in a country with high inflation.

The biggest economic success of AKP governments was bringing down inflation. That is how stability and predictability came about. But once you have high inflation a country’s balances start to get disrupted.

So inflation is going to be the main economic focus in Turkey in 2018?

I do not object to supporting growth via government incentives. But it leads to inflation, and that is the case in Turkey, where the inflation rate has hit around 11.92, the highest since 2004. In addition, core inflation - which is the rate that gives us signals for the future - has reached 12.3 percent, the highest since January 2004. That means there is a cost to this growth. Once you have state interference it means that the state is spending from its own pocket, which means a budget deficit. This is a spiral. The current deficit is not that high but looking at the last 4 or 5 years it is getting bigger. And it seems that the state will continue to have its hand on the economy in 2018.

What makes you say that?

The private sector does not have much of an appetite for investments. The U.S. Federal Reserve caused less money to circulate in global markets by raising interest rates, while Turkey needs to find $210 billion this year to make finance its debts. So the cost of lending is going to increase. At a time when the private sector is busy trying to find ways to finance its debts, making new investments creates question marks. There is no prospect of household income increasing and the private sector, which would make more investments if it were able to see household income rising, is aware of this situation.

But there is one issue that appears to be an advantage for the Turkish economy: The economy of the EU, our biggest exporter, is recovering.

But then again we are heading towards 2019 and the government, does not want to see a deteriorating economy ahead of an election. So I think it will continue with some measures to boost the domestic market. But then what will happen with inflation? One way the government can find money is by increasing taxes, but that decreases household income. In other words it takes money I had intended to spend and uses it for incentives. And anyway this is not really something that will move the economy, as it takes from one pocket just to put in another. So I think the inflationary pressure will continue to be on us.

So because there is no appetite in the private sector for new investments, the government will feel obliged to move as it is heading towards elections, and this process will limit its room for maneuver to decrease inflation.

Yes. So in this framework I don’t expect inflation to go down. The best we can hope for is that it does not go much higher. According to polls commissioned by the AKP, the economy recently replaced terrorism as the number one problem cited by voters. Why does the citizen say there are problems in the economy? Not because there is a huge current account deficit but because inflation is rising and they feel the pinch.

In addition to high inflation there is another difficulty: Oil prices, which are the most important problem in our current account deficit. Oil prices are on a rising trend. Foreign investors tend to be especially fearful about double deficits:

Deficits in both the current account and the budget. Turkey still doesn’t have a double deficit, but there has been a slight rise in our budget deficit and we might also see a rise in our current account deficit due to oil prices. Add to this the fact that 2018 will be critical in terms of preparing for elections. Then there are political and economic developments in the world and our in our region: There is Brexit. There is the fact that the U.S. comes up every day with some contentious new decision. There is the fact that Germany, the biggest power in the EU, still does not have a government. There is also what will happen in Syria and in the Middle East in general.

Are the government’s recent decisions to employ thousands of contracted workers and raise pensions populist decisions that will only make things worse in 2018?

Yes, but in the government is also increasing taxes. We woke up in the new year to a series of price hikes across various fields: From electricity to bridge and highway tolls. We can’t call this populism. These rises show that there is still at least some attachment to monetary discipline in the Finance Ministry. Still, the government has to bring inflation under control, otherwise it could be really detrimental for society.

We need foreign currency. That can come from four sources: Tourism, which has been recovering in 2017 and will do better in 2018. Exports, which are also on the rise. Portfolio investments, which are continuing. And foreign direct investment, which is the only one of these sources that is not very bright. We can handle the deficit with contributions from three of the four sources.

It would be alarming if four of the four were negative, but Turkey is certainly not at that point. However, I still underline that inflation is crucial. Indeed, under normal circumstances our inflation should really go down to single digits, to around 5 percent.

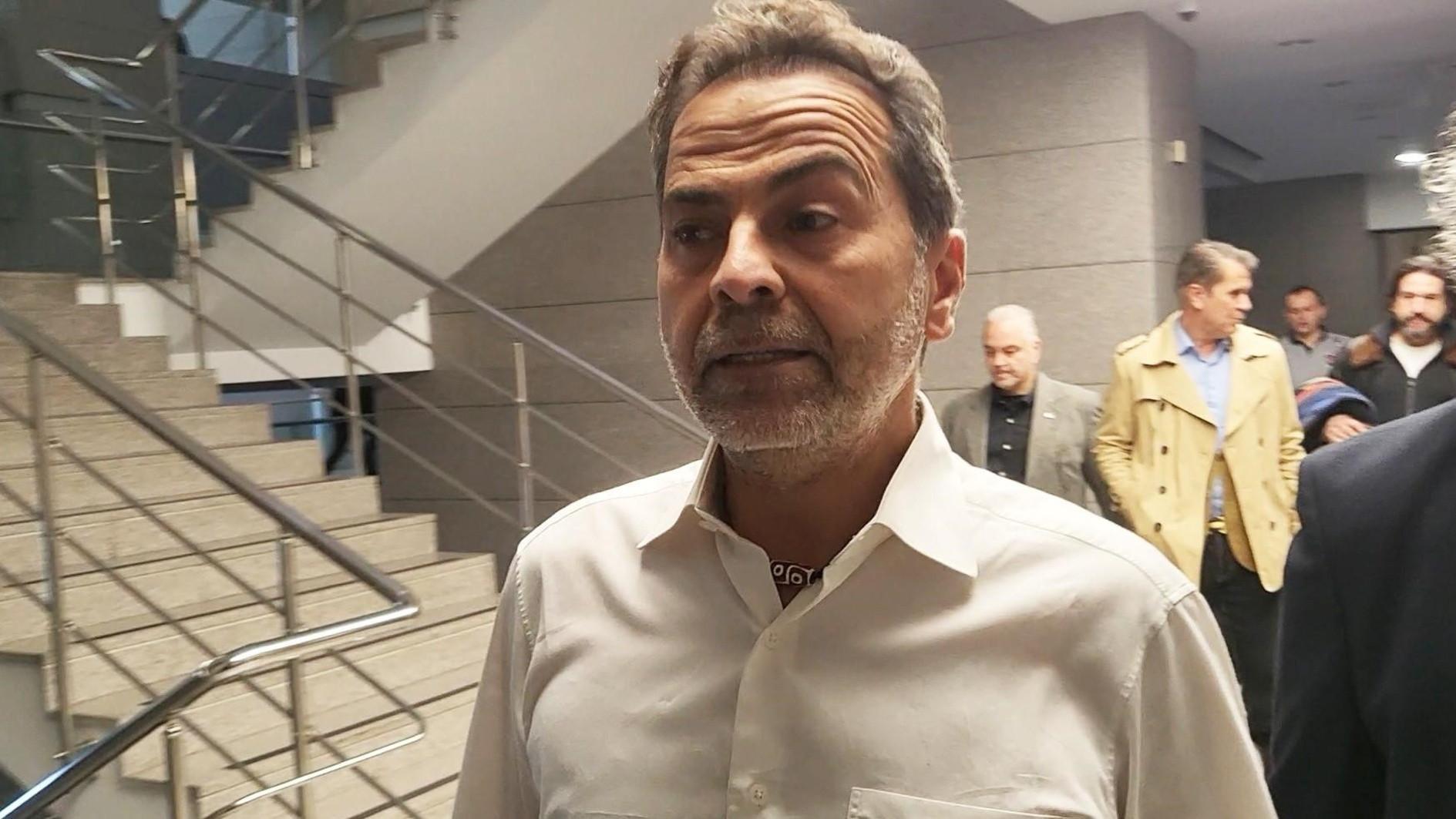

WHO IS CÜNEYT TOROS?

Born in 1972, Cüneyt Toros started his career as a journalist while studying at Istanbul University’s Management Department.

He started working as an intern in the economy section of daily Cumhuriyet in Istanbul and then moved to work at the Yeni Yüzyıl newspape r in 1994, covering the stock exchange.

r in 1994, covering the stock exchange.

Until 2010 he worked in the economy sections as an editor and section head for several newspapers such as Milliyet, Sabah and Habertürk.

He then became the deputy editor in chief of CNBC-e TV station, where his main mission was to set up the channel’s website, which became operational in 2012.

The same year he became the editor-in-chief of the Turkish-language website of the Wall Street Journal. He subsequently worked briefly as the editor-in-chief of MSN Turkey in 2015 before moving to become the editorial director of the business magazine Fortune Türkiye.