Exports grow 20 percent- I am worried!

I am probably one of the most loyal disciples of the dismal science, the term Victorian historian Thomas Carlyle coined for economics in reference to Thomas Malthus’ grim predictions of starvation: I manage to find a sad side to even the happiest economic news!

I am probably one of the most loyal disciples of the dismal science, the term Victorian historian Thomas Carlyle coined for economics in reference to Thomas Malthus’ grim predictions of starvation: I manage to find a sad side to even the happiest economic news!Preliminary exports data from the Turkish Exporters Assembly (TEA), which were released on Dec. 1, showed a remarkable 20 percent yearly increase in November. These statistics exclude gold, so the gold-for-gas trade with Iran is not included. Then, what is behind this figure?

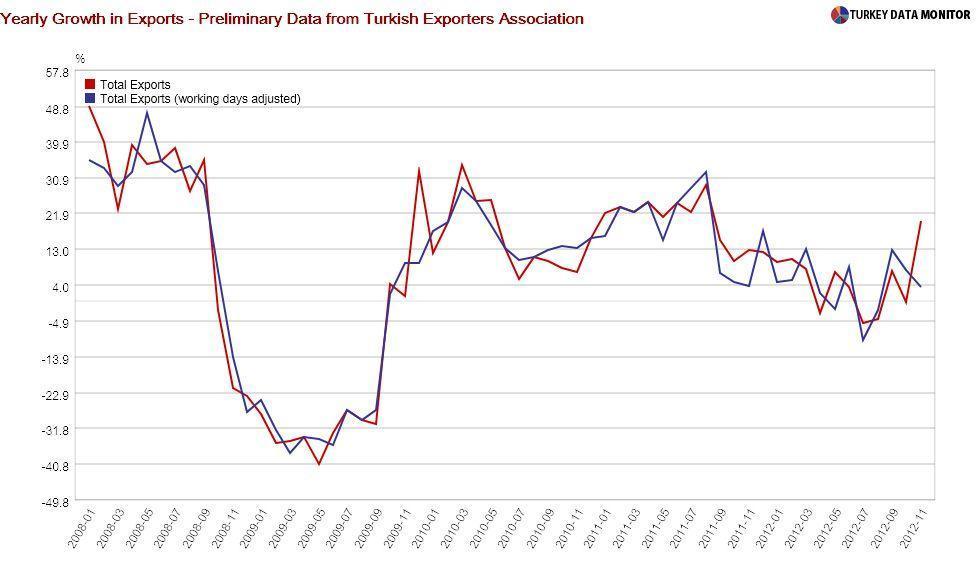

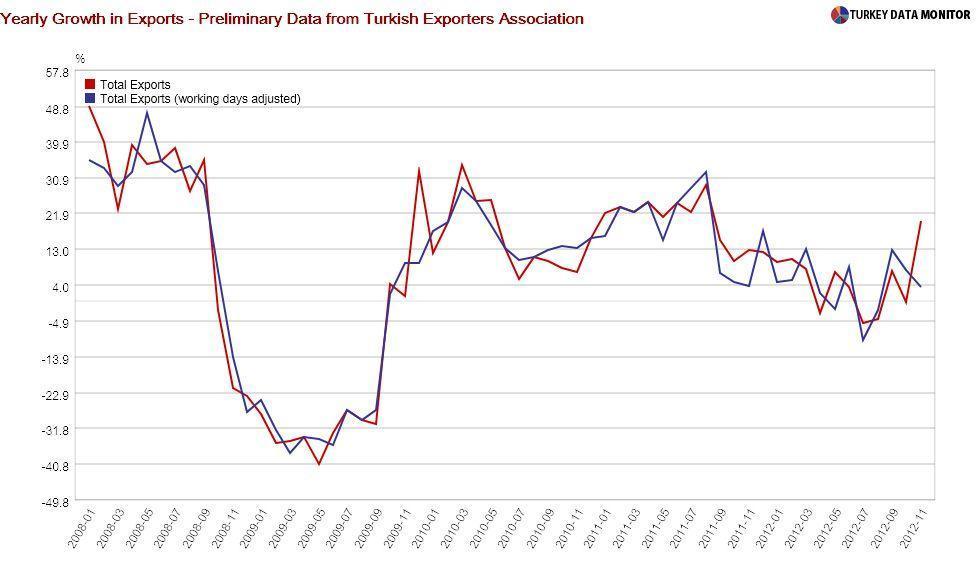

TEA President Mehmet Büyükekşi’s explanation that “exports had a good month on the back of continued success in alternative markets and partial recovery in the Euro Area” is just not my cup of tea. Most of the rise in exports is cosmetic: The feast of sacrifice was celebrated in November last year and therefore resulted in fewer working days that month. Once you adjust for the number of working days, the yearly growth in exports turns out to be a much more modest 3.6 percent.

But Büyükekşi has a point: The November Purchasing Managers’ Indices (PMIs) for the Eurozone, released Nov. 5, hinted that the downturn affecting the common currency area may indeed be bottoming out. However, the fall in the Nov. 3 Turkish PMI was driven by a sharp drop in export orders. As Capital Economics emphasized in a recent research note, this sub-index is a good leading indicator of actual exports. Therefore, I wouldn’t be surprised if Turkish exports slowed down considerably early next year.

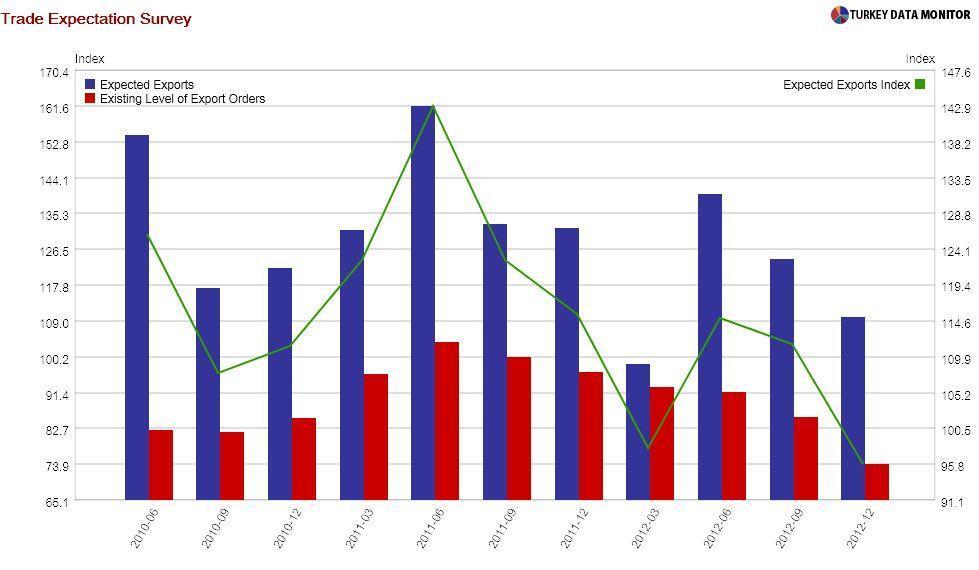

Worse still, all the major Emerging Market PMIs except Turkey and Russia recovered in November, mainly on the back of strong exports. Just as I am not making too much of one month of TEA data, maybe I should not take the November PMIs too seriously. But the exports component of the Central Bank’s real sector confidence index and the Economy Ministry’s trade expectation survey are also pointing to a slowdown in exports.

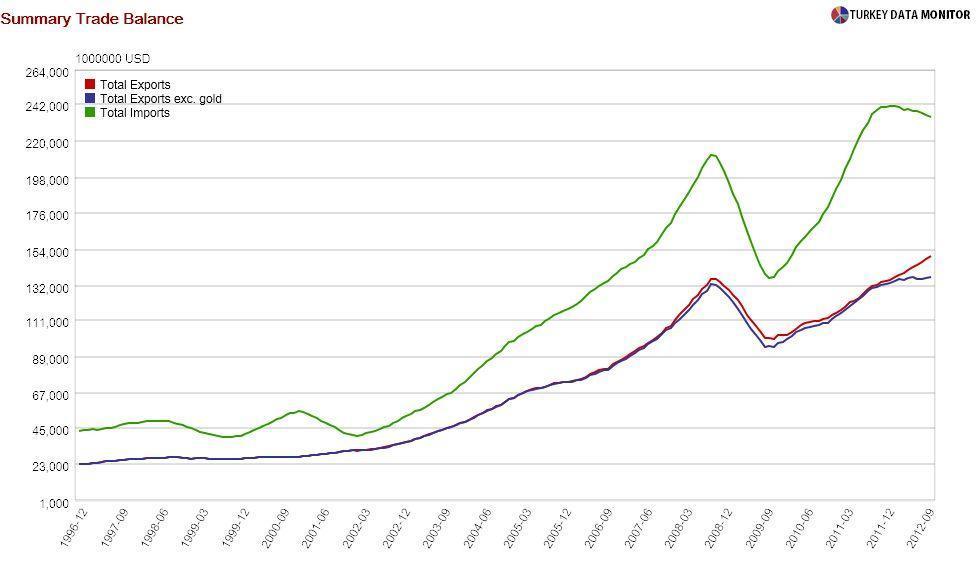

On a more general note, I have serious reservations about the “Turkish exports miracle” of the last few years. Of course, if you look at the big picture, the rise in exports looks impressive, even when you exclude the recent gold exports to Iran, either directly or through the United Arab Emirates and Switzerland. But this increase has been accompanied by an even stronger surge in imports.

To add insult to injury, Turkey’s share of world exports has actually declined since 2008, a fact carefully ignored by government officials. As for the increased exports to new markets, they come at a cost.

Ankara think-tank TEPAV notes that the technological content of the country’s exports has been falling, probably because these new markets in the Middle East, North Africa and Asia buy less sophisticated products from Turkey.

In order to bring down the current account deficit and reach its 2023 $25,000 GDP per capita target, Turkey needs to shift from a demand-based growth model to an export and supply-led one. There are no signs that we are getting there!