When I saw Central Bank of Turkey Governor Erdem Başçı confidently assert on Friday that the “lira will beat the dollar” this year, I remembered the movie that put Marion Cotillard on the map for me, long before her Oscar-winning performance in the Édith Piaf biography La vie en rose.

In

“Jeux d’enfants”, which can

be translated as “Child’s Play”, the two protagonists undertake a lifelong

competition to outdo one another with one daring stunt after another. So if I

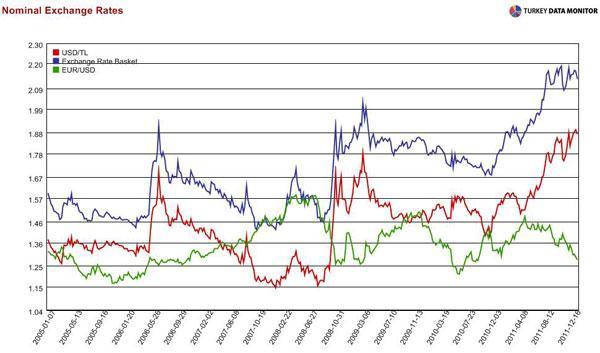

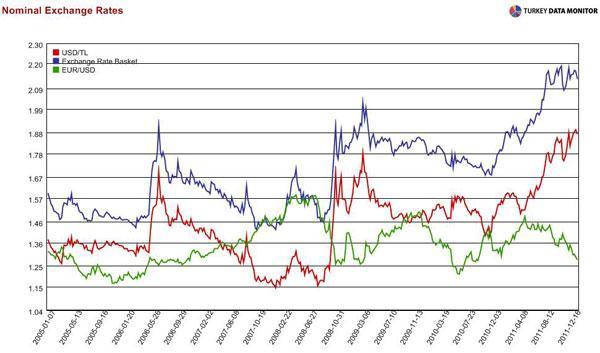

wanted to carry on with the game, I could equally boldly claim that the euro-dollar

basket will hit 2.3 sometime during the year, contrary to Başçı's assertions.

Their methodology is based on current account sustainability, and their “benchmark of +/- 3 percent of GDP as the limits on current account imbalances consistent with sustainability” is very conservative for Turkey. And, while the lira has lost 6.7 percent against the dollar since then, the real exchange rate has depreciated only slightly because of the rise in inflation. So we could see further lira weakness should the external financing environment deteriorate.

I

agree with Başçı that the current account deficit has stemmed from ample and

cheap financing in the last few years. However, that financing has dried up of

late. The capital account has been consistently lower than the current account

since July. There was actually an outflow of $ 481 million in October, and

despite the nearly $1 billion of “unidentified financing objects” (net errors

& omissions), reserve assets decreased by $3.7 billion.

Başçı is assuming that trend will not continue. On the contrary, he is confident that some of the extra liquidity pumped by the European Central Bank will find its way to emerging markets and especially Turkey, thereby strengthening the lira. For that scenario to materialize, we need no major periods of global risk aversion.

And

if investors do test the lira, Başçı contends the Centra Bank has sufficient

reserves, but traditional measures of reserve strength do not support this

claim. In fact, Turkey’s reserves look less than adequate once you take

external vulnerability into account, as a

recent IMF paper has done.

At a more fundamental level, I don’t think it is appropriate for a central bank to behave like a hedge fund, with its Governor talking so much about the country’s currency and giving investment advice. If nothing else, markets may decide to treat you as one and test you, and as Europe found out the hard way back in 1992, no reserves will then be enough.

Consistently

raising the stakes, the protagonists of Jeux d’enfants bury themselves in

concrete at the end of the movie. I hope that’s not where we find ourselves at

the end of the Central Bank’s dangerous currency game.